HK brokerage CLSA Premium survives another vote on proposed winding up

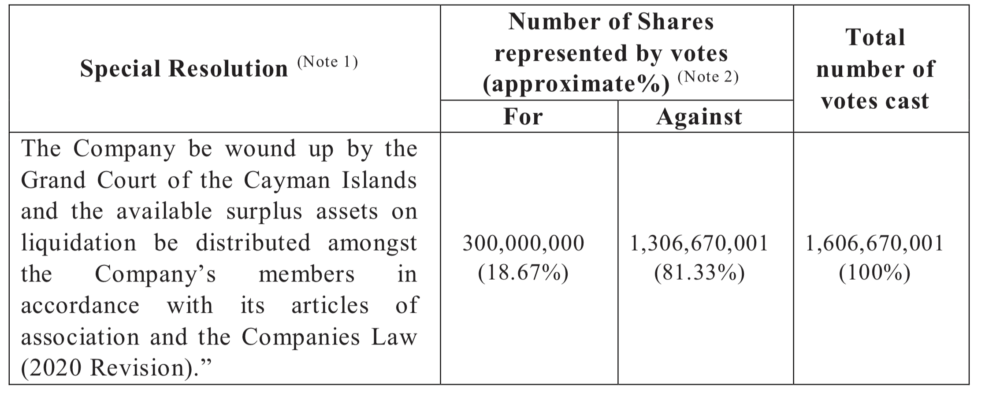

About 81% of the votes were cast against a resolution to wind up the company.

Hong Kong-focused retail Forex broker CLSA Premium Ltd (HKG:6877), formerly known as KVB Kunlun Financial Group Ltd, has survived another vote on a proposal for its winding up.

At an extraordinary general meeting held earlier today, the proposed resolution for winding up the broker was not passed. About 81% of the votes cast by the shareholders by way of poll were against the resolution.

The preceding proposal to wind up the broker was rejected in July.

The Board of CLSA Premium has recommended against the proposed resolution. The Board notes that CLA Premium has been actively carrying out a series of action to improve its business. The management of the company expects that the financial performance of the Group would gradually improve following the implementation of such business plan, and in turn it will create greater value and return to the shareholders in the long term.