HK brokerage KVB Kunlun says process of disengagement of PRC clients in progress

The brokerage has commenced a process of identification and disengagement of PRC clients in order to comply with the laws of the People’s Republic of China.

Hong Kong-focused retail Forex broker KVB Kunlun Financial Group Ltd (HKG:6877) has just posted its report for the first six months of 2019, with the document stating that a process of identification of the company’s PRC clients is in progress.

Let’s recall that, as a holder of the Australian Financial Services License, the brokerage received a letter from the Australian Securities and Investments Commission (ASIC) in April 2019 which reminded licensees that they were obliged to comply with applicable laws of foreign jurisdictions, and recommended that licensees should seek legal advice to ensure that the products and services they offer to their clients comply with applicable foreign laws.

Certain subsidiaries of the Group hold Australian and New Zealand financial services licenses. The online forex margin trading platform of the Group’s Australian and New Zealand subsidiaries is targeted towards, among others, ethnic Chinese. In view of the Letter, the board of directors of KVB Kunlun has sought legal advice from its lawyer as to the laws of the People’s Republic of China.

In line with the advice, a detailed survey of the Group’s Existing Ethnic Chinese Clients is conducted in order to identify anyone who is, or who may possibly be, classified as a PRC domestic client.

Any person identified as an actual or potential PRC domestic client will then be disengaged as soon as possible. The Identification and Disengagement of PRC Domestic Clients is still in progress, the company said in its announcement today.

In terms of results, the company posted a heavy net loss. This is in line with a recent profit warning.

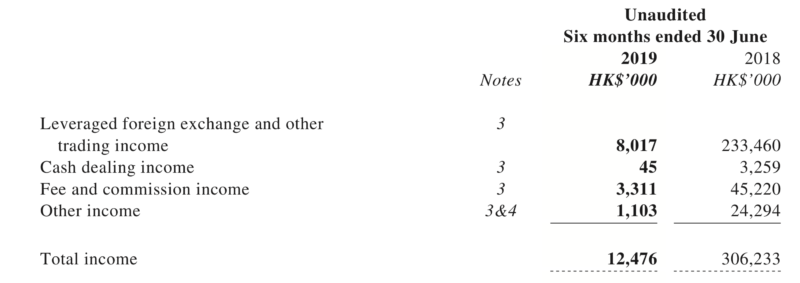

Today, KVB Kunlun reported a net loss of HK$77.1 million for the six months ended June 30, 2019 compared with a net profit of HK$10.4 million for the first six months in 2018.

The decrease in profitability of the Group was blamed on a reduction in leveraged foreign exchange and other trading income earned from external customers due to reduced volatility which led to decrease in trading volume of the Group’s customers in the reporting period, as well as tightening of regulations in jurisdictions such as Australia and Hong Kong.

The leveraged foreign exchange and other trading income of the Group decreased by 96.6% to HK$8 million for the six months ended June 30, 2019 from HK$233.5 million for the six months ended June 30, 2018. The decrease is due to lower trading volumes.