HKEX confirms resumption in derivatives market trading

There have been no connectivity issues on the trading system reported this morning from Exchange Participants.

After a turbulent day on Thursday, September 5, 2019, trading in derivatives resumed smoothly today in Hong Kong, as confirmed by Hong Kong Exchanges and Clearing Limited (HKEX).

HKEX today said that its derivatives market had successfully opened and the market was operating smoothly. There have been no connectivity issues on the trading system reported this morning to date from Exchange Participants.

HKEX confirms that the software issues in the vendor supplied trading system that caused the market outage yesterday have now been isolated. HKEX will update the market again once a full and detailed analysis of the incident and the vendor software issue has been completed.

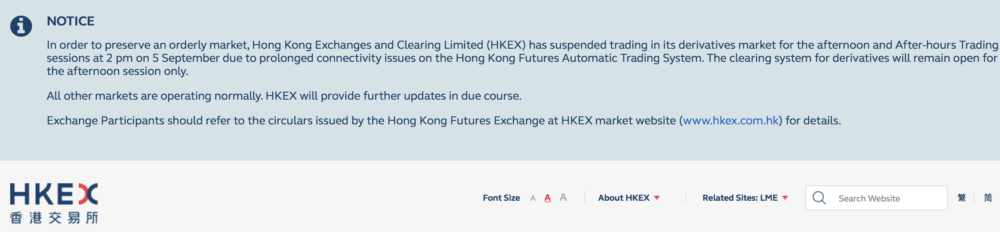

Let’s recall that, on September 5, 2019, HKEX suspended trading in the afternoon and After-hours sessions of its derivatives market at 2:00 pm, in order to preserve an orderly market. HKEX conducted and completed its preliminary investigations into the outage that caused the connectivity issues on the Hong Kong Futures Automatic Trading System.

Below is a notice displayed on HKEX’s website on Thursday while the derivatives market trading was closed.