HKEX puts costs of failed bid for London Stock Exchange at HK$123m

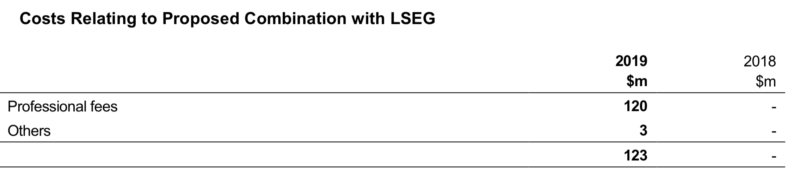

The sum includes professional fees of HK$120 million and other expenses of HK$3 million, as per HKEX results for 2019.

Hong Kong Exchanges and Clearing Limited (HKEX) has earlier today posted its final results for 2019, with the report revealing the costs for the failed bid for London Stock Exchange.

According to the 2019 report, the costs relating to proposed combination with LSEG amount to HK$123 million. The sum includes professional fees of HK$120 million and other expenses of HK$3 million.

Let’s note that, back in November 2019, HKEX estimated that the costs related to the discontinued attempt to acquire LSEG amounted to HK$130 million.

Regarding the costs, HKEX simply states that, in 2019, it carried out a detailed analysis on the proposed combination with LSEG, but decided not to proceed with making a firm offer.

On September 11, 2019, HKEX announced its intention to make a possible offer for LSEG. HKEX believed that a combination of LSEG and HKEX was strategically compelling and would create a world-leading market infrastructure group. A couple of days later, however, LSEG rejected the offer.

The Board of LSEG said back then it had fundamental concerns about the key aspects of the Conditional Proposal: strategy, deliverability, form of consideration and value. LSEG noted that three-quarters of the proposed consideration is in HKEX shares, representing a fundamentally different and much less attractive investment proposition to LSEG shareholders, as LSEG sees the value of HKEX share consideration as inherently uncertain.

Further, according to the Board, the value fell substantially short of an appropriate valuation for a takeover of LSEG, especially when compared to the significant value LSEG expects to create through LSEG’s planned acquisition of Refinitiv.

In addition, LSEG said it did not believe HKEX provides it with the best long-term positioning in Asia or the best listing / trading platform for China. LSEG insisted it values its mutually beneficial partnership with the Shanghai Stock Exchange which is its preferred and direct channel to access the many opportunities with China.

On October 8, 2019, HKEX announced it would not proceed to make a firm offer for LSEG, as it had been unable to engage with the management of LSEG in realising its vision and continuation would not be in the best interests of shareholders.