Hong Kong broker Guotai Junan registers 32% increase in leveraged FX revenues in 2017

The brokerage’s business has benefited from the increase in the average trading volume in Hong Kong.

Hong Kong-based online trading company Guotai Junan International Hold. Limited (HKG:1788) has earlier today posted a set of solid results for the year to December 31, 2017, as the business has managed to benefit from robust trading volumes.

The numbers show that the Group realized profit after tax of HK$1,336 million in 2017, up 30% from the 2016 result. In particular, the income from financial products and corporate finance witnessed a significant increase of 162% and 50%, respectively.

Also, in 2017, the revenue generated from loans and financing, corporate finance, financial products, market making and investment income contributed approximately 41%, 22% and 20%, respectively. The overall business capabilities of the group have been steadily enhanced.

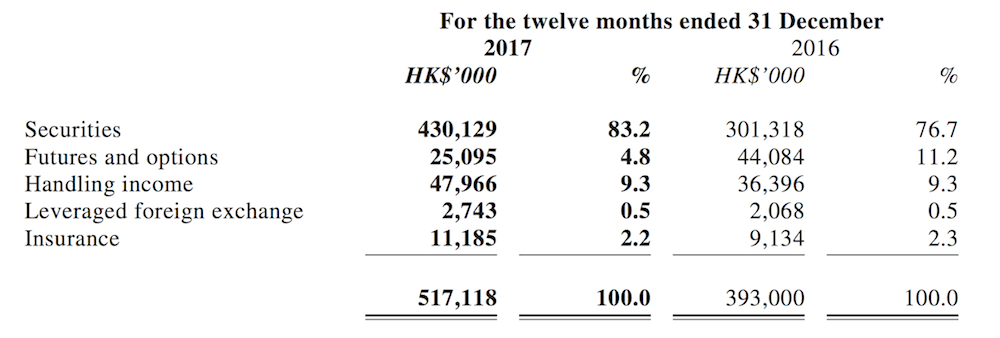

The brokerage segment saw steady growth as it benefited from various positive factors including the year-on-year increase in the average trading volume in Hong Kong. Revenue generated from the brokerage business increased steadily by approximately 32% year-on-year to HK$517 million in 2017.

Leveraged foreign exchange contributed HK$2.74 million in revenues the brokerage’s segment of the Group in 2017, marking a 32% increase from the HK$2.07 million generated in the preceding year. The increase was more pronounced with regard to securities trading, which generated revenues of HK$430.1 million, up from HK$301.3 million in revenues generated in 2016. Revenues from futures and options, however, fell to HK$25.1 million from HK$44.08 million in 2016.

In terms of significant events, Guotai Junan notes that in April 2017 it introduced the brand of “Jun Hong Wealth Management” from the parent company to provide comprehensive and customised wealth management products and services to high net worth clients.

Also, in 2017, the number of the Group’s professional investor clients rose more than twofold year-on-year, with their average account balance increasing by nearly 1.26 times year-on-year to approximately HK$33.46 million. Also, as of the end of 2017, the clients’ assets under custody have increased by 31% to HK$224.4 billion as compared to the end of last year.

The brokerage stresses the importance of a reliable and efficient online trading platform to the expansion of its business. In the second half of the year, the mobile trading platform “Guotai Junan International Tradego” of the company provided users with brand new features, after undergoing a complete system revamp, which provides convenient and speedy services by integrating information and trading functions, the user experience was further enhanced.

During the period under review, 84% of the brokerage commission was generated from online trading system of the company.

During 2017, the Group’s total assets increased by 64% to HK$73.96 billion – this compares to HK$45 billion at December 31, 2016. The Group’s total liabilities increased by 83% to HK$62.97 billion as at December 31, 2017 (HK$34.47 billion as at December 31, 2016).