Hong Kong brokerage Guotai Junan registers 25% Y/Y drop in profits in H1 2018

Revenues from the leveraged FX segment marked a slight decrease in annual terms and amounted to HK$1.49 million in the first six months of 2018.

Hong Kong-based online trading company Guotai Junan International Hold. Limited (HKG:1788) has earlier today posted its performance metrics for the first half of 2018. After a solid 2017, the first six months of 2018 were more challenging for the broker.

During the six months ended June 30, 2018, the total profit attributable to equity holders of the Company amounted to approximately HK$507 million, representing a decrease of about 25% from the result of HK$674 million registered in the equivalent period a year earlier.

Excluding the effect of the income (particularly on brokerage and corporate finance businesses) arising from the listing of the parent company in the first half of last year, the Profit Attributable to Shareholders for the first half of 2018 increased by 13.6%. During the period under review, income from the Group’s financial products business increased significantly, presenting a growth of impressive 271% year on year.

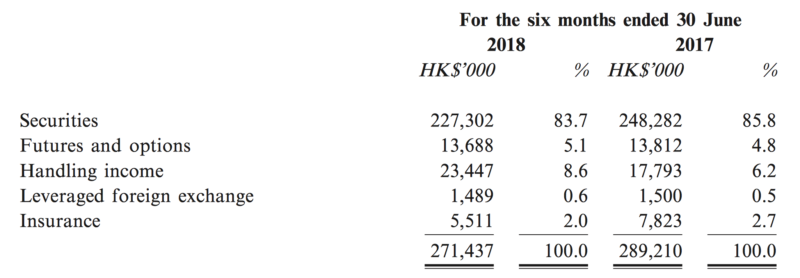

In the first half of 2018, the Group’s brokerage business registered a total revenue of approximately HK$271 million (2017: approximately HK$289 million). Excluding the effect of the income of the Company arising from the listing of the parent company in the first half of 2017, the brokerage income grew by 40.4% year-on-year (2017: HK$193 million), among which the commission income from securities trading in the Hong Kong market soared by 60% to HK$155 million.

Revenues generated by the leveraged FX business were barely changed from a year earlier at $HK1.49 million.

Although the Hong Kong stock market encountered certain fluctuations during the period under review, new products and services launched by the Group in the second half of last year, such as the preferential financing rate, “Jun Hong Wealth Management Club” service, and the upgraded mobile trading platform of “Tradego”, were very popular and have attracted many quality customers. Furthermore, the number of the Group’s professional investors (those with investible assets of over US$1 million) has increased steadily to 1,758 (2017: 1,080) in the first half of 2018, with average account balance increasing by nearly 54% to approximately HK$38.03 million as compared with the same period of last year.

During the period under review, the overall income of the Group’s financial products, market making and investment business increased by 99% year-on-year to approximately HK$344 million (2017: approximately HK$173 million). In particular, the financial product business, as one of the fast-growing businesses in recent years, achieved impressive performance with a significant increase in income of 271% year-on-year. Taking the advantages on its leading credit ratings as well as well-established partnerships with major international financial institutions, the Group refined its product competitiveness and business strength, which enabled itself to provide diversified and tailor-made financial products for corporations, institutions and high net worth clients.