Hong Kong brokerage KVB Kunlun renews IT services agreement with Banclogix

The renewed agreement’s term is from January 1, 2019 to December 31, 2021.

Hong Kong-focused Forex broker KVB Kunlun Financial Group Ltd (HKG:6877) has earlier today announced the renewal of its IT services agreement with Banclogix.

On December 28, 2018, KVB entered into the Renewed Information Technology Services Agreement pursuant to which Banclogix agrees to provide software development services, software maintenance services, information technology infrastructure project management services and information technology infrastructure maintenance services to the broker. The renewed agreement is on substantially the same terms as the existing agreement.

The term of the renewed deal is from January 1, 2019 to December 31, 2021.

The agreement states that a software development fee will be charged by the cost actually incurred as listed in the Statement of Work agreed by the relevant Group Company and Banclogix prior to the start of the development. Unless otherwise specified in the Statement of Work, the following charging rates are set: Project Manager – HK$6,000/per day; System Analyst – HK$5,000/per day; and Analyst Programmer – HK$4,000/per day.

In respect of software maintenance services, an annual software maintenance fees is calculated at 15% of each signed Statement of Work and sequential change request(s) for each completion of the software for the relevant Group Company.

Regarding infrastructure project management, an information technology infrastructure project management fee will be charged by the cost actually incurred as listed in the Statement of Work agreed by the relevant Group Company and Banclogix prior to the start of the project. Unless otherwise specified in the Statement of Work, the following charging rates are set: Project Manager – HK$6,000/per day; Infrastructure Support – HK$5,000/per day.

In addition to the above, Banclogix has undertaken that it shall provide its services on terms which are no less favourable than that available from other independent third party suppliers for the same or similar services.

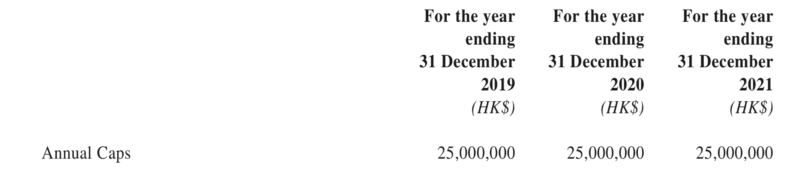

KVB’s Directors have considered and proposed that the annual caps in respect of the transactions contemplated under the Renewed Information Technology Services Agreement should be HK$25million for each year.

The annual caps were determined by reference to the estimated demand of the Group for each of the software development and maintenance services, information technology infrastructure project management and maintenance service to be received and the relevant prices.