Hong Kong’s SFC: About 13% of all licensed corporations are controlled by Chinese shareholders

About 13% of all LCs are now controlled by Mainland-based corporate shareholders, as compared to 9% in 2012, the SFC says.

The latest SFC Compliance Bulletin, published earlier today by the Hong Kong Securities and Futures Commission (SFC) highlights the greater financial market integration between mainland China and Hong Kong. This is reflected in the increasing number of Mainland entities choosing to establish or extend their financial services businesses in Hong Kong through setting up new licensed entities or acquiring existing ones.

In 2012, the Mainland overtook the United States to become the largest source of shareholder groups controlling licensed corporations (Lcs), the SFC notes. According to the SFC Compliance Bulletin, about 13% of all LCs are now controlled by Mainland-based corporate shareholders, as compared to 9% in 2012.

In addition, after the November 2014 launch of Shanghai-Hong Kong Stock Connect, the number of stock exchange participants in Hong Kong has climbed steadily.

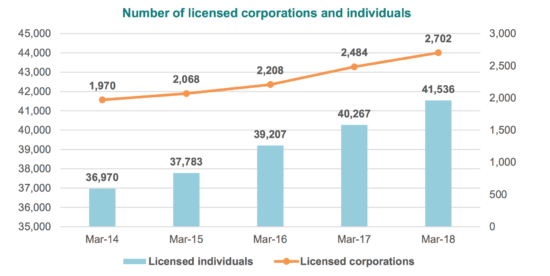

Over the past five years, the number of SFC licensees has marked a substantial growth. The number of LCs and licensed individuals increased at annual compound rates of 7% and 3%, respectively. As of March 31, 2018, the total number of licensees in Hong Kong reached a historical high of 44,238, up 3% from the previous year, while the number of LCs surpassed the 2,700 mark.

In the face of these optimistic statistics, let’s note the data for late 2017 indicating a drop in license applications. The SFC quarterly report for the three-month period to December 31, 2017, has shown that the number of new license applications fell in quarterly terms.

In the final quarter of 2017, the regulator received 1,924 licence applications, down 9.6% from the preceding quarter and up 7.7% year-on-year. The number of corporate applications rose 50.8% from the last quarter to 98, up 18.1% year-on-year.

The SFC has come under fire in the latest Annual Report of the Process Review Panel into the regulator’s activities in 2016/17. The regulator was criticized over its clumsy procedures for reviewing license applications and complaints, for lack of appropriate fintech training of staff and poor communication with complainants.

For instance, PRP reviewed nine licensing applications for different types of regulated activities in the year. The processing time of the cases ranged from seven months to seven years and one month. For all these cases being reviewed, PRP raised concerns about how the case officers, their supervisors and the senior management had monitored the case progress.

PRP recommended that the SFC enhances its monitoring of the processing of licensing applications. Specifically, the senior management should be informed of the status of the outstanding applications so that they could provide timely guidance to the case officers if necessary, and ensure that appropriate resources were allocated for effective processing of the applications.