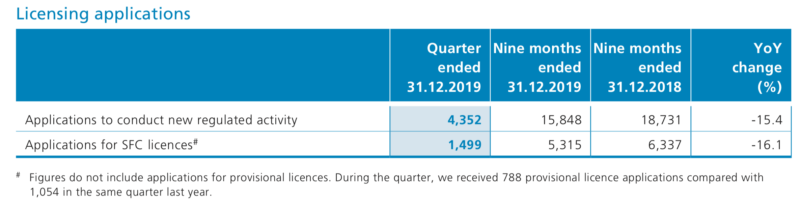

Hong Kong’s SFC receives 1,499 licence applications in Q4 2019

The number of applications is down 27.2% from the third quarter of 2019 and down 23.3% year-on-year.

Hong Kong’s Securities and Futures Commission (SFC) today published its latest Quarterly Report which summarises key developments for the three-month period to end-December 2019.

The data reveals a drop in license applications in quarterly and annual terms. The regulator reports that it received 1,499 licence applications in the final quarter of 2019, down 27.2% from the preceding quarter and 23.3% year-on-year. The number of corporate applications decreased 39.7% from the preceding quarter to 44. The annual drop was 30.2%.

Let’s recall that the regulator announced in December that annual licensing fees for the financial year 2020-21 will be waived in view of the current challenging market environment.

As at 31 December 2019, the number of licensees and registrants totalled 47,437, up 2.3% from last year, and the number of licensed corporations grew 6.2% to 3,084.

Highlights of the quarter included the launch of a consultation on proposed changes to the open-ended fund companies regime to encourage more private funds to set up in Hong Kong and the release of a position paper setting out a new licensing framework for virtual asset trading platforms.

The SFC also published consultation conclusions on enhancements to the investor compensation regime which raised the compensation limit to $500,000 per investor per default and on proposals to impose margin requirements for non-centrally cleared over-the-counter derivatives to help reduce systemic market risks.

The SFC conducted 76 on-site inspections of licensed corporations to review their compliance with regulatory requirements. Five licensed corporations and five individuals were disciplined, resulting in total fines of $413.3 million.