Hong Kong’s SFC waives licensing fees for 2020/21

The decision aims to relieve the regulatory cost burden on the securities and futures industry.

There has been a bit of positive news for investment firms licensed in Hong Kong, as the Securities and Futures Commission (SFC) today announces waiving the annual licensing fees for the financial year of 2020/21.

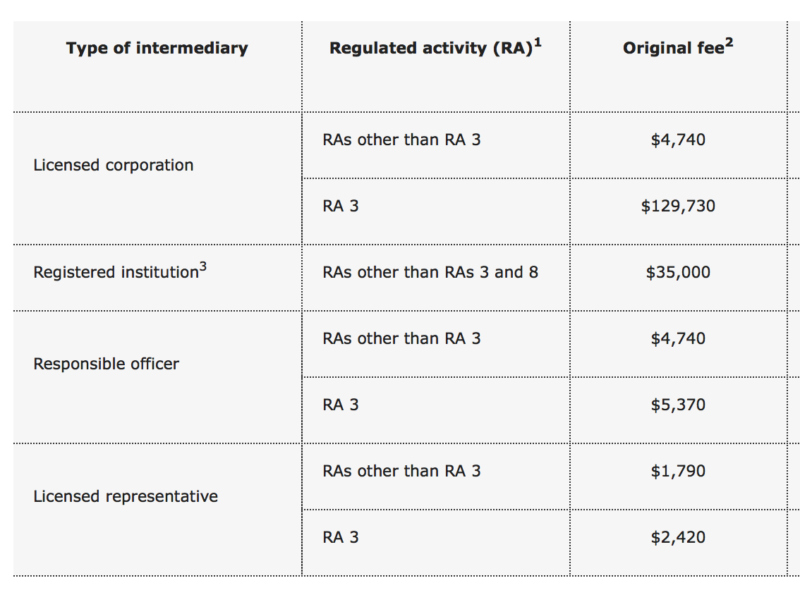

The fee waiver applies to annual licensing fees payable by all licensed corporations, registered institutions, responsible officers and representatives. It does not apply to any other fees, such as licence application fees and transfer fees. The annual licensing fees payable before April 1, 2020 will not be affected by the waiver.

The decision aims to relieve the regulatory cost burden on the securities and futures industry having taken into account the current challenging market environment. The waiver of the fees will cost approximately $117.5 million in forgone revenue for the financial year 2020/21 in addition to the 50% waiver already announced earlier this year.

Chief Executive Officer of the SFC, Mr Ashley Alder commented:

“We hope this goodwill gesture will provide a certain degree of financial relief for over 47,000 licensees and registrants in particular smaller firms amidst the current economic downturn”.

The SFC’s report for the April-June quarter revealed a drop in number of license applications received.

During the quarter, the regulator received 1,756 licence applications, down 10.5% from the previous and 13.5% year-on-year. The number of corporate applications dropped 14.3% from the last quarter to 66, down12% year-on-year.

As at June 30, 2019, the number of licensed corporations reached a record high of 3,017, up 51% from the same period in 2014 and 8.7% from last year. At the same time, the number of licensees and registrants totalled 47,239, up 4.7% year-on-year.