How сan а Business Connect To Swapin?

The problem of quickly transferring cryptocurrency to fiat remains relevant and it is difficult to find a suitable service for this common scenario

The Estonian project Swapin was founded in 2017, which was created by a team of professionals with extensive experience in the crypto and blockchain industries.

Today, Swapin solutions have already been used by thousands of private clients and large companies from various segments. The company aims to completely change the daily financial flows for millions of users and offers unique crypto-to-fiat solutions focused on both B2B and B2C segments.

About Swapin

Swapin is a processing service that aims to bridge the gap between the world of digital assets and the traditional financial sector. The platform is easy to use and provides its users with various solutions that are suitable for both individuals and businesses. Swapin opens up truly limitless opportunities for integrating the digital economy into the traditional one.

The company offers unique solutions for direct and fast transfer of crypto to a personal or corporate IBAN account. Individuals can now send crypto to friends or family, as well as pay for purchases or bills with cryptocurrency.

The business also offers a solution for accepting crypto payments with automatic conversion to fiat without problems related to accounting, tax, and other financial compliance issues. Swapin tools for business open up the opportunity for companies to invoice for payment with digital assets. Online stores can also integrate a widget to accept payments in cryptocurrency.

Business Solutions

Today, the platform offers two tools for business: CoinCollector and the E-com widget.

CoinCollector: The tool enables businesses to issue invoices in EUR, which can be paid in cryptocurrency. After the payment is made, the company receives fiat to the connected corporate IBAN account.

CoinCollector generates a unique link for payment in cryptocurrency and sends it to the client. After receiving an invoice for payment from the seller, the client must fill in all the required fields:

- Select cryptocurrency

- Specify the amount in EUR

- Payment Description

- Referral number (optional)

- Contact Email

- Confirm the validity of the entered data

- Click “Proceed”

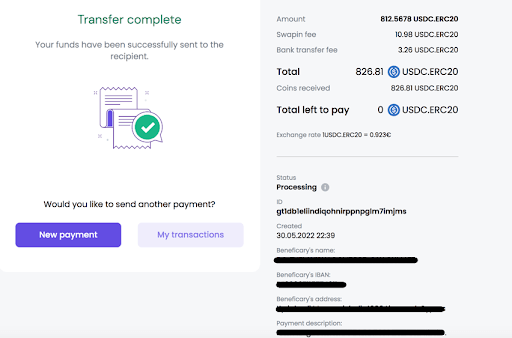

After that, the Swapin service calculates the exact amount in cryptocurrency, provides the client with a crypto wallet address to initiate the transfer and fixes the amount for 30 minutes to protect the value of the cryptocurrency from volatility and avoid any associated risks. The customer makes a transfer and upon completion of the transaction, the seller will receive payment in EUR to the bank account.

The seller will receive EUR in the bank account, after completion of the transaction.

E-com widget: This widget is developed specifically for online stores. It is easily integrated into the website for receiving payments. The client is given the opportunity to make a purchase using cryptocurrencies, while the seller receives an instant transfer of the requested amount in fiat to the corporate IBAN account.

How to connect a business to Swapin?

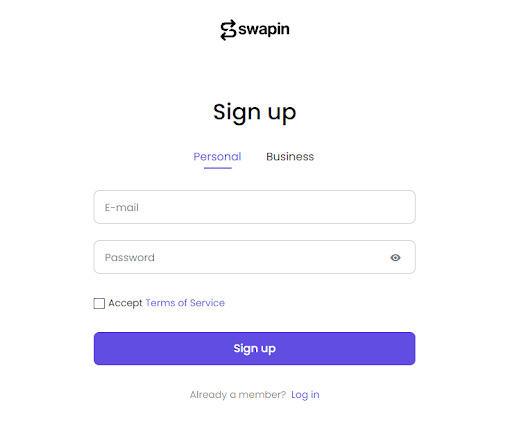

On the Swapin platform, a user can register a personal or corporate account. The second option is more suitable for companies. To create a business account, the user needs to enter the name and legal form of the company, as well as provide an email address and set a password.

To complete account registration, the user needs to verify the email address. An email will be sent to the email specified during registration, in which you need to click on “Verify email”. After that, the business account will be ready and access to all platform tools will be provided.

Conclusion

The Swapin service has already revolutionized crypto-to-fiat payments. The development of the company will help to significantly increase the interest of the mass audience in cryptocurrencies as a means of payment. The variety of ready-made solutions presented on the Swapin platform make it possible for cryptocurrency owners to forget about the problems that arose previously when attempting to convert crypto-to-fiat.

In 2022, Swapin intends to launch an InstaBuy solution for buying cryptocurrencies quickly and easily by using a VISA/MasterCard and bank transfer.

Cryptocurrencies as a form of payment can be a great solution for businesses that incorporate digital assets in their operations or revenue model. Swapin users can attract a new audience to their business in order to enable new income streams. Scale business with Swapin!