How wide of the mark is trade surveillance among Tier 1 market participants? PwC investigates the challenges

Multinational professional services, outsourcing and audit consultancy PriceWaterhouseCoopers (PwC) has produced its Market Abuse Surveillance Survey 2016 which analyzes the methods by which regulatory authorities ensure good conduct among institutions and electronic trading firms, ranging from how trading incidents are handled, to the method by which companies structure their advertisements in order to solicit new […]

Multinational professional services, outsourcing and audit consultancy PriceWaterhouseCoopers (PwC) has produced its Market Abuse Surveillance Survey 2016 which analyzes the methods by which regulatory authorities ensure good conduct among institutions and electronic trading firms, ranging from how trading incidents are handled, to the method by which companies structure their advertisements in order to solicit new business.

In this year’s survey, PwC considers one of the biggest challenges in financial markets to be how to conduct effective surveillance to spot market abuse and rogue trading.

Compiled by Graham Ure, a PwC Partner and Stephen Shelton, a PwC Director, both of whom are based within the Surveillance and Data Technology operations within the consultancy, along wiht Rukshan Perlam, a PwC Director responsible for the firm’s Market Abuse division, and Roger Braybrooks, a PwC Partner responsible for Front Office Supervision, the report goes into great detail.

The consultancy deduces that surveillance has yet to deliver as a fully effective tool for preventing market abuse in financial markets, putting this largely owing to limitations in technology and a lack of clarity about optimal organisation of responsibilities and activities.

In terms of how to conduct monitoring of market activity, PwC considers the stakes to be too high for the banks to do anything other than invest further and rely on emerging technologies to plug the gaps.

PwC says that within the last five years, financial institutions have incurred losses from rogue trading incidents, and have been investigated and fined over allegations across a range of market abuses.

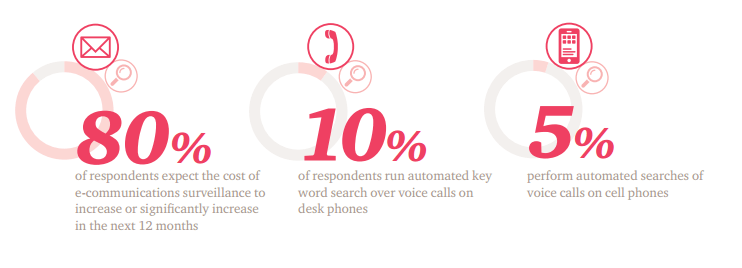

Interbank rate and foreign exchange market manipulation have cost the banks over $19bn in fines globally and the FCA alone issued in excess of £1.4bn in fines relating to these issues between 2013 and 2015. Regulators increasingly expect banks to monitor communications and trading activity to help identify and prevent future instances of market abuse.

Mind your language!

However, over 140,000 people work in banking in London alone. That equates to tens of billions of emails, messages and phone calls every year. In a fast moving environment, those communications often use highly colloquial language and rapidly evolving terminology.

PwC’s report considers that in order to be truly effective, surveillance needs to be able to spot new or emerging forms of abuse which it says is usually likely to involve only a few traders and a handful of transactions within this ocean of data.

The question is whether banks can really use surveillance as an effective tool to prevent future instances of misconduct, market abuse and rogue trading, reading every message and checking every trade, or are the challenges too great?

In all, twenty of the largest global banks participated in the survey, each with a significant presence in EMEA. The survey was conducted during December 2015 and January 2016.

Key questions

The survey highlights that banks are taking surveillance very seriously, and backing that commitment with extra investment and larger dedicated teams, but a number of fundamental questions remain.

Are banks truly on top of trader chatter?

Many banks use lexicons – libraries of the key words and phrases that may indicate suspicious behaviour – to support their surveillance of the millions of messages they generate each day.

A moot point remains as to whether lexicons are dynamic and agile enough to capture the increasingly subtle and obfuscated language that traders use? Historic investigations across the financial services sector have highlighted how criminally-minded traders use code words and creative slang to disguise abusive behaviour.

Will natural language processing techniques or new advances in voice analytics provide a better result, or will the growing sophistication of wrong doers mean they continue to elude detection?

Is surveillance technology really delivering?

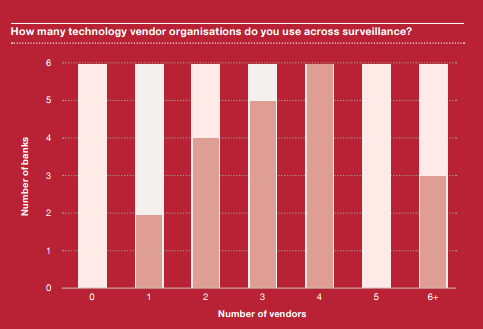

Over the past 18-24 months, there have a number of new entrants to the surveillance market, providing a genuine alternative to traditional vendors. These new surveillance vendors seek to address aspects of the “big data” conundrum, tackling the challenges of analysing large volumes of data structured in myriad forms quickly enough to prevent potential abuses occurring.

While the innovation driving vendors to bring new ideas and approaches to surveillance is welcome, PwC poses the question as to whether there is danger that the proliferation of choice and analytical advancements is causing more confusion rather than clarity, and even with advances in analytics, whether the quality of surveillance relevant data in the banks good enough to support their effective use.

Banks are still concerned about the regulatory direction of travel and the impacts that this may have on additional requirements for surveillance.

Specific concerns they raise include the EU market abuse regulations and possible extensions of the scope of surveillance required across both asset classes and trading processes. As well as future uncertainty, it is clear today that technology is not yet working as well as banks need it to. The survey found widespread dissatisfaction with error rates and the high cost of reviewing inaccurate alerts from automated monitoring of both electronic messages and trade patterns.

In particular, more than 65% of tier 1 firms believe that the number of false positives (electronic messages or events incorrectly flagged as high risk) currently generated by trade surveillance systems is unacceptably high.

Technology vendors and the Big Brother factor

It is clear that one solution really does not fit all. 70% of respondents are using three or more vendors to execute their surveillance requirements. Each vendors approach is slightly different and banks are having to cast a wide net to gain some comfort. There is still a lack of convergence in this market – something wanted by the users of surveillance, but not necessarily being fully addressed by the vendor market.

Banks are steadily expanding the teams tasked with reviewing thousands of flagged messages every day. Teams listening to ‘phone calls’ are also growing, as automated phonetic and transcription voice technologies are increasingly being looked at but are not yet seen as a proven substitute for manual review.

PwC states that while spending is expected to rise as teams expand further, the criticality of getting surveillance right means banks are largely reluctant to explore outsourcing or other cost saving initiatives. Only 15% of those surveyed have outsourced second line of defence surveillance activities, and only 24% have considered doing so.

Deciding where surveillance activities are performed and by whom is still a work in progress for most. Some larger banks are handing greater responsibility to front office teams, but others are still working out where responsibilities should lie between the first and second lines of defence (Compliance).

Surveillance –primarily a first-line activity?

The Front Office has always been accountable for running its business responsibly. Through its good conduct it generates solid, sustainable profits. In doing so, the Front Office assumes accountability, acting as the first line of defence for the institution and stopping potential issues at source.

However, historically, it is Compliance in the second line of defence that has held responsibility for surveillance. But why should this be the case when it is employees in the Front Office that are most likely to lose out? Does it not make more sense to place surveillance in the first line of defence?

It seems evident that those running the business (and who may be personally liable if things go wrong) should have control over surveillance, providing the information needed to take the right decisions at the right time. The regulatory direction of travel suggests this shift needs to happen. But are institutions on board? Do Front Office and Compliance agree on this?

Finally, the survey asks how will Compliance’s role transform to ensure the business is still policed, which is very much a work in progress in many cases, and most certainly, with the ever evolving nature of the execution and trade reporting rules across the most prominent electronic trading jurisdictions, is likely not to be something that can be concluded overnight.

Chart and infographic courtesy of PwC