How Will Ethereum Markets Respond to the Merge?

A moment that’s been years in the making is approaching fast—the Ethereum blockchain will soon abandon mining and transition to Proof-of-Stake (PoS) consensus

The exact time of when the Merge will happen will depend on conditions on the Ethereum blockchain, although practically all estimates say it will most likely happen in mid-September.

The biggest improvement that we’ll see immediately after the Merge is a drastic reduction in Ethereum’s environmental impact. The Ethereum Foundation estimates that the Ethereum network will consume 99.5% less energy after the Merge is completed. This is because the network will no longer require energy-intensive cryptocurrency “mining” to achieve consensus and validate transactions.

On the performance side, the Merge itself will not bring any noticeable improvement in terms of transaction speeds and costs. This means that alternative blockchains like BNB Chain and Solana, as well as layer 2 platforms like Arbitrum and Optimism, will continue to be relevant even after Ethereum adopts Proof-of-Stake.

However, the Merge will establish the foundation for future upgrades to the Ethereum network, which will result in major scalability improvements. The exact timeline for when we can expect technologies like sharding to be implemented into Ethereum is unclear, so it could take a while for the Ethereum network to become capable of handling thousands of transactions per second.

As the Merge approaches, many crypto investors are wondering whether the Merge will have a big impact on the Ethereum price. Based on technical indicators, crypto market data platform CoinCodex predicts that Ethereum could reach almost $2,200 one month from now. However, the situation in the broader cryptocurrency market suggests that investors should be careful with their expectations.

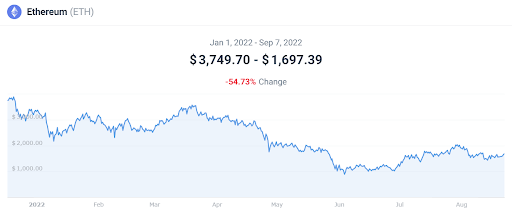

The markets for ETH have been quiet in the lead-up to the Merge

ETH traders have been cautious in the lead-up to the Merge—the Ethereum price declined from $1,700 to $1,580 (-7%) between August 1 and September 1, even though the Ethereum Merge is expected to happen sometime in mid-September.

The main reason for this is simple. The cryptocurrency market as a whole is in a slump that’s driven primarily by macroeconomic conditions. Investors are spooked by rising interest rates that central banks have been using to combat inflation, making them less likely to invest their money in highly volatile and speculative assets like cryptocurrencies.

In addition to the macroeconomic conditions, the cryptocurrency market is also in the middle of correcting from the all-time highs and speculative euphoria that dominated the market in 2021. Looking back, it seems quite obvious that the 9-figure sports sponsorship deals signed by crypto companies, as well as the massive rallies displayed by “meme coins” like Dogecoin and Shiba Inu, were clear signs of a bubble.

Investors could also be worried that an ambitious technical upgrade such as the Merge might not go as expected, and result in further delays. The upgrade has already been successfully implemented on three Ethereum testnets, which is why most observers are confident that the Merge will be a success from a technical standpoint.

After the Merge completes, it will of course be interesting to follow what happens in the ETH markets. Some traders might be looking to “sell the news”, so a sell-off following the upgrade is certainly inside the realm of possibility. On the other hand, a smooth upgrade could instill confidence in the Ethereum project and its ability to execute technically challenging projects.

The Merge will significantly improve Ethereum’s long-term prospects

From a fundamentals perspective, the Merge will have a significant impact on the issuance of new ETH. Simply put, there will be no more need to issue new ETH coins to reward miners, and the amount of ETH that is issued to reward Proof-of-Stake validators is significantly smaller.

Prior to the Merge, about 13,000 ETH is issued every day to reward miners, while only 1,600 ETH per day is issued to reward users participating in Ethereum staking. After the Merge, the ETH supply will inflate at a much slower pace, and could potentially even become deflationary depending on how much ETH is burned through EIP-1559. This likely won’t be reflected in the markets immediately, but could serve as a positive influence on the price of ETH over the long term.

Overall, we can expect that Ethereum’s Proof-of-Stake upgrade will not have a drastic impact on the ETH markets in the short term, but could be a big driver of growth over the long term.

The significantly lower environmental impact could make the Ethereum blockchain suitable for environmentally conscious companies and individuals, and the reduced issuance will make ETH more appealing as a long-term investment. Down the line, the scalability improvements from future upgrades like sharding will make widespread adoption of Ethereum technically feasible.

Common questions about the Merge:

What is the Merge?

The Merge refers to the process of combining the Proof-of-Work Ethereum mainnet and the Proof-of-Stake Beacon Chain into a single network that uses Proof-of-Stake. After the Merge, Ethereum will offer the same smart contract capabilities of the previous Proof-of-Work mainnet, but the consensus will be handled through Proof-of-Stake and miners will no longer be a part of the Ethereum network.

Will Ethereum be faster and cheaper to use after the Merge?

According to Ethereum developers, the Merge itself will not bring any significant benefits in terms of transaction speeds and costs.

What will happen to staked ETH after the Merge?

After the Merge is completed, users that staked their ETH on the Beacon Chain will still not be able to withdraw their funds. This will only be possible after an additional upgrade called Shanghai.

Do I have to do anything to secure my ETH coins during the Merge?

If you’re an ETH holder, you don’t have to take any extra steps because of the Merge. You can continue holding ETH in your Ethereum wallet or in your cryptocurrency exchange account. Most of the major cryptocurrency exchanges are supporting the Merge.