HSBC reports steep drop in profits in Q1 2020

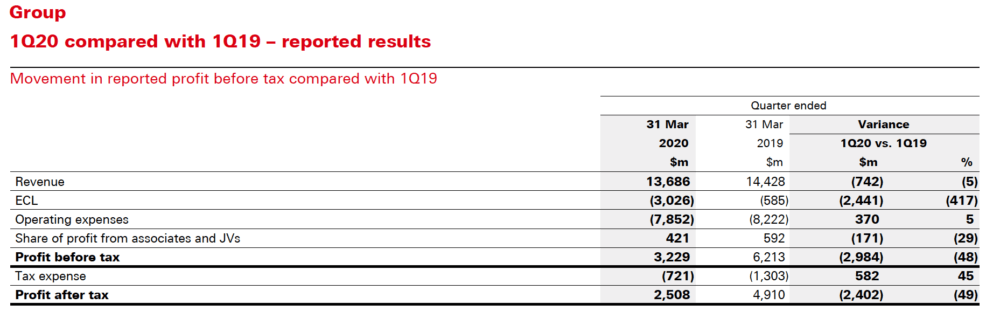

Reported profit after tax amounted to $2.5 billion, 49% lower than in the year-ago quarter.

HSBC Holdings plc (LON:HSBA) has just reported its financial results for the first quarter of 2020, with profits marking a steep decrease from a year earlier.

Reported profit after tax for the first quarter of 2020 amounted to $2.5 billion, down 49% from the first quarter of 2019. Reported profit before tax was down 48% to $3.2bn.

The results reflected higher reported ECL and lower reported revenue. Whereas performance in the first two months delivered good results, the global impact of the Covid-19 outbreak and weakening oil prices had a significant adverse impact on HSBC’s performance in March.

The reduction in reported profit before tax included a net favourable movement in significant items between the periods of $0.3bn, mainly from favourable fair value movements on financial instruments of $0.3bn. Significant items in reported operating expenses were broadly unchanged and included higher restructuring and other related costs of $0.1bn, which were broadly offset by lower structural reform costs of $0.1bn and a decrease in customer redress programs of $0.1bn.

Revenues for the first quarter of 2020 amounted to $13.7 billion, down 5% from the corresponding period a year earlier. The result included a net favourable movement in significant items of $0.3bn, mainly from fair value movements on financial instruments, which were broadly offset by adverse foreign currency translation differences of $0.3bn. The remaining reduction reflected decreases in RBWM, GB&M and Commercial Banking (CMB), partly offset by higher revenue in Corporate Centre. Excluding foreign currency translation differences and significant items, revenue decreased by $0.8 billion or 6%.

In terms of outlook, HSBC commented:

“The outlook for world economies in 2020 has substantially worsened in the past two months. The impact and duration of the Covid-19 crisis will likely lead to higher ECL and put pressure on revenue due to lower customer activity levels and reduced global interest rates. We plan to reduce operating expenses to partly mitigate the reduction in revenue and we intend to continue to exercise cost discipline, while maintaining strategic investment. These factors are expected to lead to materially lower profitability in 2020, relative to 2019”.

HSBC has temporarily delayed parts of its transformation, including some elements of its cost and risk-weighted asset (RWA) reduction program, and expect restructuring costs for 2020 to be lower than indicated in its 2019 annual results.

Noel Quinn, Group Chief Executive, said:

“I take the well-being of our people extremely seriously. We have therefore paused the vast majority of redundancies related to the transformation we announced in February to reduce the uncertainty they are facing at this difficult time. We continue to press forward with the other areas of our transformation with the aim of delivering a stronger and leaner business that is better equipped to help our customers prosper in the recovery still to come.”