IBKR’s FX deposits drop 10%, market share shrinks to 5%

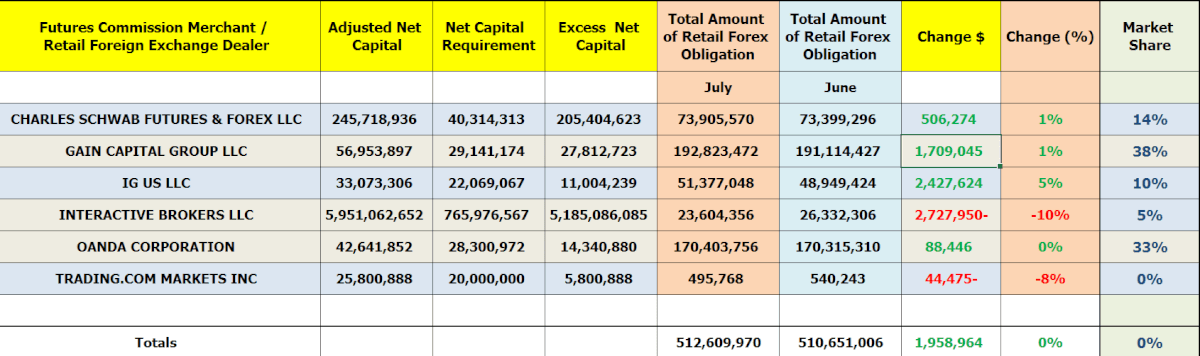

Retail FX deposits at US brokerages, which have been struggling to eke out a profit in a strict regulatory environment, rose slightly in July 2022 by less than $2 million, CFTC data showed.

The brokers, including FCMs that are registered as Retail Foreign Exchange Dealers (RFEDs) and those included as broker-dealers, saw a total positive change month-over-month from June, though differences amongst each broker were more pronounced.

Back to the figures, the FX funds held at registered brokerages operating in the United States came in at $512 million in July, which was more than the $510 million reported in June 2021.

According to the CFTC dataset, four of the six FX firms listed notched increases in retail forex obligations including GAIN Capital, OANDA Corporation, IG US and Charles Schwab.

The best performer for the month was IG US which saw an overall rise of $2.4 million to $51.3 million at the end of July, compared to $48.9 million at the end of June, or an increase by five percent month-over-month. The US business of Europe’s largest spread better overtook IBKR as the fourth largest holder of retail FX funds —something that only happened a number of times with Charles Schwab as both companies duke it out for dominance.

Meanwhile, the most notable loss was made for the second consecutive month by Interactive Brokers, which saw a drop of $2.7 million, or nearly 10 percent month-over-month.

The newest comer to the US FX industry, Trading.com Markets, saw its customer deposits drop to $495K in July, down 8 percent from $540K a month earlier.

Looking at the market share of different brokers, the distribution slightly changed in July relative to the month prior. GAIN Capital remained the leader in terms of market share, commanding a 38 percent share. OANDA also solidified its stance as the second largest in the US with 33 percent market share – Charles Schwab and IG US retain a 14 and 10 percent share respectively.

The chart listed below outlines the full list of all FCMs that held Retail Forex Obligations in the month ending on July 31, 2022 – for purposes of comparison, the figures have been included against their June 2021 counterparts to illustrate disparities.