Tradeworks now also targets IBs with powerful new features – Interview with FinanceFeeds

“IBs are an increasingly important factor in the retail FX ecosystem, especially so here in Asia and hence their requirements constitute an important aspect of our road-map” says Thomas Nyegaard at Tradeworks in Singapore

Copenhagen and Singapore-based broker-neutral trade automation platform Tradeworks this morning spoke to FinanceFeeds with regard to the recently launched new features which are aimed at targeting IBs.

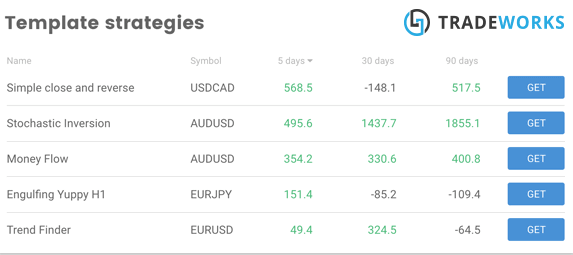

Earlier this year, the company launched an in-app template strategy library where traders can find ready-made strategies and their performance over the past 5, 30 or 90 days. The objective here was to offer a simple and effective way for traders to discover the advantages of algo trading. All the strategies being free, traders can copy these across to their personal Tradeworks profile in a simple click and edit, duplicate, backtest and deploy these as they wish.

Speaking to FinanceFeeds this morning from Singapore, Thomas Nyegaard, Head of Tradeworks Asia said “We are constantly trying to break down the barriers of entry to algo trading for the retail trader and our template strategy library is a great step forwards.”

“The best strategies have already been copied more than 5000 times and have since been duplicated and edited in thousands of different permutations by the individual traders. Our user interface allows traders to build strategies without any programming skills and the ready-made strategies gives some great canvases for them to work with and thereby familiarize themselves with Tradeworks” said Mr. Nyegaard.

According to Mr. Nyegaard, the next step in broadening the appeal of Tradeworks was for the company to launch peer-to-peer (P2P) strategy sharing. This feature allows a Tradeworks trader to seamlessly send a given strategy to anyone with a Tradeworks user-profile.

The sender can choose whether to send the strategy as ‘open’ and thereby allowing the recipient to see, edit and share the strategy with others or as ‘black box’ and where the recipient is unable to share with others and only able to set trading size prior to deploying the strategy.

As IBs increasingly adopt various automation technologies such as MAM and PAM to assist their customers with trading, this feature is specifically designed with this type of market participant in mind. Additionally, Tradeworks believe their product will find many fans among the legions of individual traders who have moved away from traditional point-and-click in search of an easy and low-cost way into automated trading. +

Mr. Nyegaard explained “IBs are an increasingly important factor in the retail FX ecosystem, especially so here in Asia and hence their requirements constitute an important aspect of our road-map.”

“This is why we have made a conscious decision to make our product an attractive tool for the IB to use in his day to day business and our P2P strategy sharing feature is designed specifically with the IB in mind.”

“The feature makes it extremely simple for the IB to design and share EAs with his network while at the same time helping his customers save time and money. We also see this feature as an important building block in our endeavors to build up a global Tradeworks community where traders build, share and monetize strategies in various ways around our unique codeless platform’” said Mr. Nyegaard.

“The P2P sharing feature is however just an early step in the company’s long-term plans of becoming the go-to platform for traders wishing practice algorithmic trading without having to teach themselves code language.”

“Our long-term vision is to build an ecosystem around the Tradeworks platform which will be appealing for various types of market participants be they IBs, brokers, educators and, of course, the individual trader. We want to become the dominant platform where individual traders build, test and sell their automated trading strategies without any need for code and the next step after P2P strategy sharing will be an open but curated marketplace where talented traders can publish their winning strategies for others to follow or purchase outright” concluded Mr. Nyegaard.