IG Academy mobile app reappears with brand new design

IG has made it clearer and easier to navigate the app, which seeks to help traders learn more about the market.

Electronic trading major IG Group Holdings plc (LON:IGG) has just released a new version (2.2.1) of the IG Academy application for iOS devices.

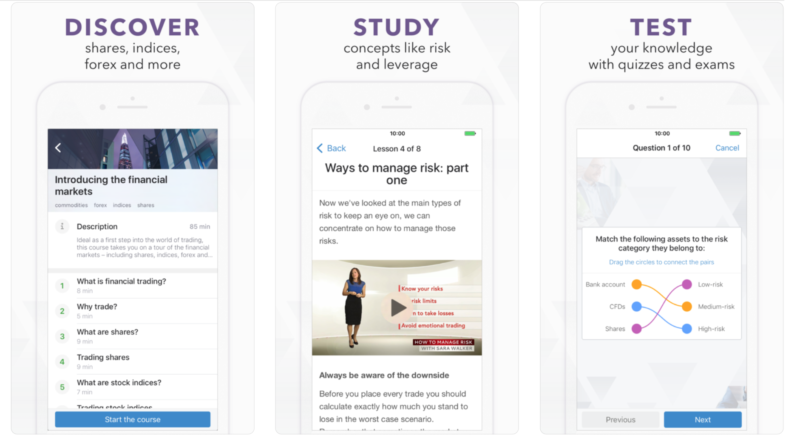

In this release, the broker has given its app a brand-new design, making it clearer and easier to navigate.

IG Academy, as its name suggests, aims to teach its users how to trade straight from their phones.

Downloading IG Academy is free of charge. Users may learn about trading financial assets such as shares, indices, Forex and commodities, and find out how to capitalise on both rising and falling markets. They can also discover how to trade using leverage, execute orders and develop a trading plan. The application also offers traders a way to understand risk management and how to protect their profits or limit potential losses. From a purely psychological point of view, the solution enables traders to gain the confidence to decide what, when and how to trade.

IG Academy provides clear, step-by-step courses for traders and investors of all levels. It is particularly useful now, in the current regulatory environment, as traders need to boost their knowledge and to assess adequately the degree of their expertise. It is also a useful tool for those seeking to refresh their trading knowledge and develop new strategies.

The solution includes explanatory videos, expert tips, stats and facts, so that it aims to deliver a detailed yet comprehensible introduction to trading. Once users have studied the theory, they can put their knowledge to the test with a range of quizzes and exams.

The application is available in English, French, and German.

In the meantime, IG continues to enhance its new web trading platform. The list of recent improvements includes capabilities allowing better customization of charts and easier access to HLOC (High, Low, Open, Close) data.

The company has received a lot of suggestions to have the HLOC data display by default on the charts instead of having to right click and go to Show->HLOC Data. In response to the demand, IG has implemented this change. As a result, by opening a chart traders should now see the HLOC data display as a default. They can still hide this data by right clicking->Show->HLOC Data.

Another new tweak is the feature that enables traders to hide or change the colour of the background grid on the charts. IG has now added this feature to increase traders’ ability to customize their charts, and traders are able to completely hide the grid or change the colour of the grid.

Earlier this year, IG added a new feature to the platform enabling traders to pre-set a timeframe. This means that traders can select to view data for 1day, 1 week, 1 month etc up to a period of 5 years. Once they have selected the timeframe of their choice, the chart will reload and snap to the selected period.