IG adds measure tool to new platform charts, enhances copying of signals

In response to traders’ requests, IG introduces a measure tool for an accurate view of the price and time difference between two points on a chart.

FinanceFeeds has been keeping its readers informed about the developments around the new web trading platform of IG Group Holdings plc (LON:IGG). Since its initial rollout towards the end of 2016, the platform has enjoyed some significant improvements, with the latest raft of these unveiled yesterday.

If we have to summarize the enhancements, we should say that they are focused on simplifying the trading process and cutting the time for working with order tickets, as well as on making trading more precise.

First off, traders now have the option to open standalone tickets without charts. To do that, one can select a market name, right-click on it and select “Open ticket” from the menu. Another way to do it is to right click on a market from the main menu, or from an existing chart. Any tickets traders have open are saved automatically as part of the workspace.

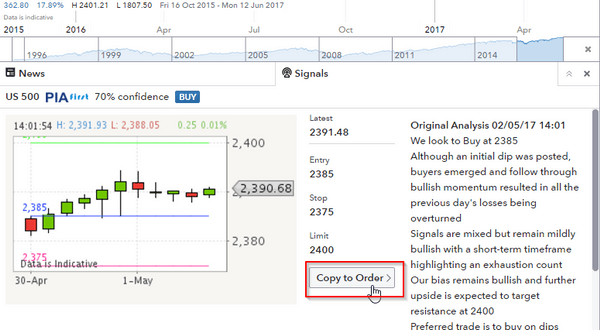

Another improvement is the feature that allows copy signal details to an order ticket. To do this, traders simply have to select the “Copy to Order” button on the signal. This will insert he relevant order level, stop and limit in an Order ticket.

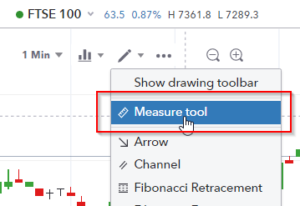

Another important addition is the availability of a measure tool in the new platform charts. This feature is introduced in response to traders’ requests. It provides an accurate view of the price and time difference between two points on a chart.

To use the new measure tool, one has to click the drawings menu on the top left of a chart window, or right-click a chart and select Drawings > Measure tool.

Then, the first click allows to choose the first point on a chart, and a second click allows to choose the second point.

In the end of March this year, as FinanceFeeds has reported, IG added a raft of new features to its platform. These included enhancements to the news section, new ways of sorting open positions and beefed-up watchlists. These enhancements followed the upgrades announced in February – ranging from sound alerts to a darker color theme.

And, since we have already mentioned charting, let’s note that IG’s new web platform offers access to online charting software for technical analysis & trading ProRealTime to all countries where the broker operates. The latest version of the software allows the use of game pads as input devices and offers improved detailed reports, including performance charts. Traders can view and assess their weekly, monthly, quarterly or yearly performance. There are also improvements to the quick access interface which has new order types added to it that were previously only available in the advanced interface. The variety of new order types includes Stop with limit protection, One cancels the other, At market if touched, etc.