IG adds new tech analysis tools, simplifies work with watchlists and signals on web trading platform

The ability for traders to view signals on a market window, new ways to sort watchlist columns, and Fibonacci extensions are amid the additions.

Less than a couple of weeks after online trading firm IG Group Holdings plc (LON:IGG) introduced a set of enhancements to its new web platform, the company is ready with a raft of new improvements for the users of the solution. Work with signals and watchlists is further simplified, whereas the number of drawing tools is increased thanks to the newly added functionalities.

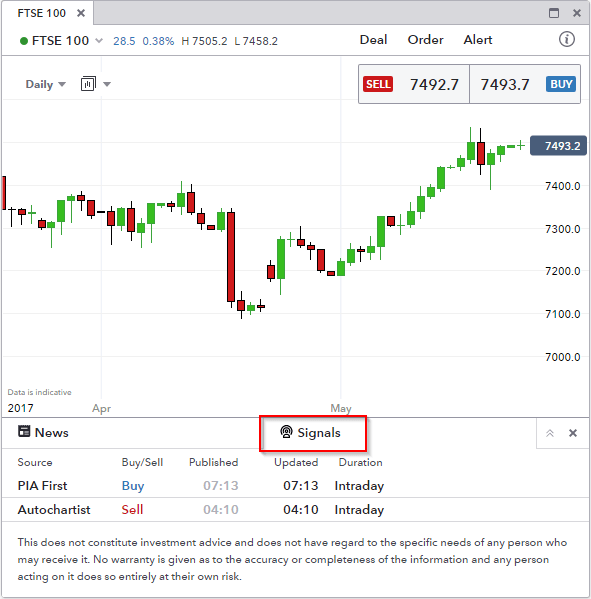

The first new addition is the ability for traders to view signals on a market window, to make it easier to see the signals they are interested in. To make use of this functionality, traders should select the Signals tab at the bottom of a market window.

Traders can select a signal to see the full details in the panel and Copy the details to an order if they wish to trade. Let’s recall that the feature that allows copy signal details to an order ticket became available to users of IG’s new web platform about a couple of weeks ago. If traders select the “Copy to Order” button on the signal, this will insert he relevant order level, stop and limit in an Order ticket.

Work with watchlists has been simplified, as IG has added new ways for traders to sort watchlist columns: Spread, % Spread, and Range. Users of the platform can add these columns using the menu on the watchlist panel. Once a column is added, one can select the column header to cycle through the sorting options. IG also promises that manual re-ordering (via drag-and-drop) is on its way.

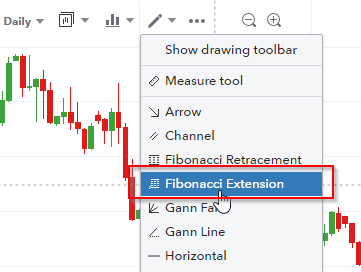

Another of the newly added functionalities concerns analysis. In response to client requests, IG has added Fibonacci extensions to the new platform charts. Traders can access this feature from the drawing tools menu on the new charts. To apply Fibonacci extensions to a chart, one has to select the tool from the menu. Click once to select the first price point on the chart, then click again on the second point.

The rollout of IG’s new web trading platform began in phases towards the end of 2016, with UK spreadbetting clients of the company being the first to get access to the platform in January 2017. After receiving encouraging feedback from its clients, IG has continued with the rollout and the addition of new features.