IG adds new trade analytics tool

The tool is designed to help traders evaluate and improve their trading performance.

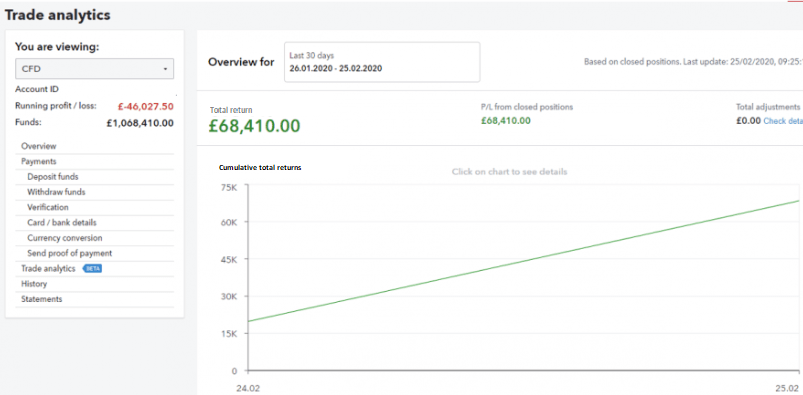

Electronic trading major IG is offering traders to discover a new trade analytics tool, which aims to help traders evaluate and improve their trading performance.

Traders can access the tool directly in the platform. It enables traders to:

- Gain deeper insight into their winning and losing trades;

- Identify and eliminate expensive trading mistakes;

- See their total returns, including all fees and adjustments;

- Monitor how much they pay in costs and charges.

The IG team explains that the feature aims to allow traders to keep building on their trading successes. To do that, traders need data that lets them see exactly what worked well, and what did not. That’s why IG will soon be adding extra features to make trades even more transparent, as IG continue to enhance the tool.

The new feature can be found in the ‘live accounts’ tab in My IG if one selects ‘trade analytics’ on the left-hand menu.

Speaking of IG’s offering to its clients, let’s recall that in February this year, IG confirmed the release of its new share dealing platform. The platform enables trading in more than 10,000 shares, trusts and investment funds.

The platform enables traders to add watchlists, markets, etc, thereby customizing the workspace. Traders can name the workspaces and add more workspaces at their own discretion. Users of the platform can browse all markets sorted by popularity from the left-hand menu. Traders can apply filters to search for stocks, ETFs, etc. To stay updated, traders can make use of the news and analysis feed available on the right side of the platform. More detailed information may be viewed by visiting the left-hand menu and selecting “News & Analysis”.