IG enhances mobile charts

A new feature available on mobile enables traders to see a preview of a position when placing a trade.

Electronic trading firm IG Group Holdings plc (LON:IGG) has announced the addition of a new feature on mobile charts set to enhance the trading experience when placing a deal.

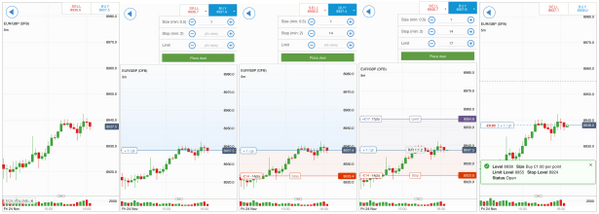

Traders can now see a position preview whilst placing a trade. On the picture below you can see how it would appear on mobile when interacting with the buy/sell option on the charts.

The company said it believes the new feature would be of use to for some of its clients, although some may think this is actually too much visual noise. That is why, IG has also provided a way to de-activate the preview from the “Show” menu.

For now this feature is only available on mobile but IG says it is working on porting this over to the new web trading platform.

While enhancing the charting capabilities on mobile, IG has terminated the offer of some of the applications. Earlier this week, the company confirmed that it stopped offering the application for Apple Watch. The move happens more than two years and a half after the launch of the solution and is attributed to weak demand from IG’s client base.

Talking of charts, we should not forget that IG’s new web platform continues to add functionalities that suit the needs of technical analysis fans. In October, for example, the platform started offering ‘Indicator’ alerts which can be added via the ‘Alerts’ tab on a chart.

In August, the platform gave traders the opportunity to make use of up to eight Moving Averages. And in May, IG responded to client requests by introducing Fibonacci extensions to the new platform charts. Traders can access this feature from the drawing tools menu on the new charts. In July, the broker added an Elliott Waves tool to the new platform charts. It can be found in the drawing menu at the top of the chart, or by right-clicking on a chart. Traders can then pick five points on the chart to form the drawing.