IG Group platform crashes yet again, with traders being left out in the cold

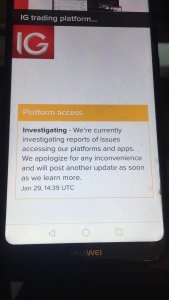

Once again, IG Group’s retail platform has crashed, leaving traders unable to close trades and nobody is answering the phones, whilst IG Group responded immediately to FinanceFeeds once we began to investigate this matter, denying the issue raised by clients.

Once again, IG Group’s retail trading platform has begun to experience outages, with traders unable to access it, representing another day of chaos for the company.

IG Group, which is one of the largest CFD and spread betting companies in the world and is publicly listed on the London Stock Exchange has over 45 years of establishment under its belt, however the past few months have proven extremely difficult in terms of access to its platform.

Today, one particular professional trader who has an account with many brokerages including IG Group explained to FinanceFeeds “Once again the IG platform has crashed leaving me and other traders abandoned, and not able to close their positions.”

“This adds huge profits to IG Group as the positions will run until they enter negative balances and then the system will automatically close them out. I have tried all day to get through and absolutely nobody answers the phones” said the trader.

“I think its an absolute disgrace. This keeps happening and this is one of the biggest firms in the world for CFDs and it has a platform that crashes and traders cannot access their positions, but my point is that IG will automatically close and wipe out these positions and who gets the benefit? The B-book at IG and there is nobody to turn to for help, as it is impossible to get through” he said.

There have been a few outages in the last two years, but the most significant recent one was in November 2020 when volatility around the news of a Covid vaccine potentially being launched sent pharmaceutical stocks into volatility. At that time, IG admitted that several of its investors were unable to check the value of their investments for around 30 minutes.

As soon as we began to report this, IG Group senior management immediately contacted FinanceFeeds, thus public image is vital to the company, whereas picking up the phone to their customers who cannot close trades has proven somewhat more difficult.

IG Group’s senior executive explained to FinanceFeeds today “Regrettably, some clients experienced intermittent log in issues for a short period today, this is linked to unprecedented demand. This has not been a problem isolated to IG, a number of other brokerages have experienced intermittent problems in recent days.”

“Our interests are aligned with that of our clients, we operate a hedged business model, externally hedging risk where appropriate. We want our clients to trade well and successfully. Where a client experiences problems we will support them through this” said the IG Group spokesperson.

“IG does not close out positions in the way described” continued the IG Group spokesperson. “In keeping with ESMA and FCA rules, positions for retail clients are automatically closed out when equity on the account falls to 50% of required margin. This would also apply to pro clients unless they have made an express alternative arrangement with IG. It is difficult to comment further without knowing the individual circumstances and arrangements in place for this client.”

“Some clients have experienced log in issues today, this is linked to unprecedented demand and was rectified within an hour of the US markets opening. As you will be aware a number of brokerages have experienced intermittent problems in recent days” concluded the IG Group spokesperson.

That is all very well, but if the platform is out of action and no client can log in, and nobody at IG Group answers the phones – something that has happened several times during periods of volatility recently, this is an important issue that FinanceFeeds maintains we are right to raise.

Years have passed in which the lack of volatility has provided a level market for b-book firms, and now volatility has returned, it appears to be an issue for large retail brokerages.

We can also note that IG Group under the stewardship of former CEO Peter Hetherington was a bastion of high quality and stability. Once he left, things have never been the same, demonstrating that it really does matter who is in the top leadership position. Mr Hetherington should be remembered as one of the great industry leaders.

Additionally, traders should consider their options and look toward working with multi-asset brokerages which use genuine prime of prime liquidity and don’t run a fully internalized system.

There is something to be said for market volatility, however if the largest companies in the market have become so accustomed to low volatility that they are unable to operate under times such as these, there perhaps needs to be an adjustment regarding the method by which risk management is conducted, as times are changing rapidly at the moment.

Evolution is most certainly the way forward.