IG Group registers 62% jump in net trading revenues in Q1 FY21

The rise in revenues reflects a combination of continued high levels of trading activity from existing clients and growth in the active client base.

Electronic trading major IG Group Holdings plc (LON:IGG) today issued an update on its revenue for the three months to the end of August 2020 (“Q1 FY21”).

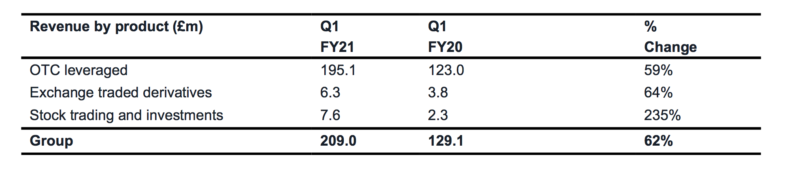

Net trading revenue for the three months to August 31, 2020 was £209 million, 62% higher than the same period in the prior year (Q1 FY20: £129.1 million). Performance was boosted by a combination of continued high levels of trading activity from existing clients and growth in the active client base, with 201,500 total active clients, up 50% on the prior year (Q1 FY20: 134,100); 134,800 clients traded OTC leveraged products in the quarter (Q1 FY20: 92,300).

Q1 FY21 revenue in the Core Markets was £170.8 million, up 56% on the prior year (Q1 FY20: £109.4 million). Performance of the Retail client base in UK and Europe was particularly strong, with growth delivered in both revenue per client and number of active clients.

Q1 FY21 revenue in the Significant Opportunities portfolio was £38.2 million, up 94% on the prior year (Q1 FY20: £19.7 million) and is on track to deliver the medium-term target of £100 million in revenue growth from this portfolio by the end of FY22.

New client acquisition remained strong as a result of continued demand and improved marketing effectiveness across multiple channels, with 34,600 new clients placing a first trade in the quarter, 129% higher than the prior year, with 23,500 of these representing new OTC leveraged clients.

To date, new client retention rates, including the Q4 FY20 cohort, are following similar trajectories to historical averages.

Let’s recall that, in FY20, IG delivered record revenues and profits, with growth across all regions and products. It also built momentum and achieved significant progress towards its medium-term financial targets and the broader diversification of the business.

Net trading revenue was £649.2 million in FY20, 36% higher than the prior year. This performance was underpinned by good growth in the first three quarters of the financial year, prior to the heightened market volatility in the fourth quarter of FY20. In the first three quarters, net trading revenue of £389.7 million was up 9% on the prior year period (Q1-Q3 FY19: £359.0 million).