IG Group registers drop in revenues in Q3 FY19

The company registered a 12% quarter-on-quarter drop in net trading revenues attributing the decline to lower volatility.

Online trading major IG Group Holdings plc (LON:IGG) has earlier today posted a trading update for the three-month period to end-February 2019, with the numbers revealing a drop in revenues amid lower volatility and the effects of the ESMA measures.

Q3 FY19 is the second quarter when the ESMA product intervention measures that impose restrictions relating to the offering of CFDs and which prohibit the offer of binary options to Retail clients in the UK and EU, were in effect throughout, the company explains.

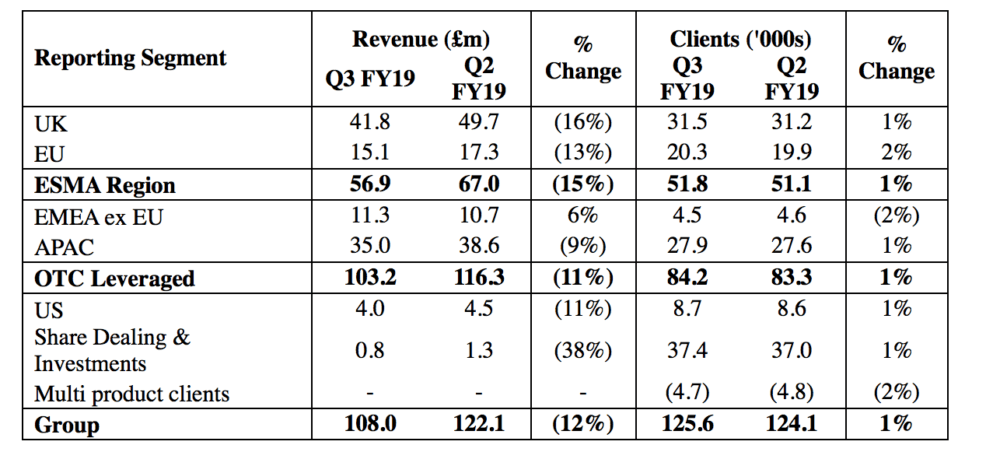

Net trading revenue was £108 million in the third quarter of FY19, 12% lower than in the second quarter of FY19. No annual comparison was provided. The lower revenue in the third quarter compared with the second quarter was blamed on lower revenue per client which reflects the reducing levels of volatility in financial markets throughout the quarter, culminating in persistently low levels of volatility and market activity in February.

The total number of OTC leveraged active clients in the third quarter increased by 1% to 84,200.

On the brighter side, IG says it sees continued demand for its products and services, with 7,742 new OTC leverage clients placing a first trade in the third quarter compared with 7,553 in the second quarter. During the third quarter, a further 1,425 ESMA region Retail clients applied to be classified as Professional, with 14% of these applications accepted. The proportion of ESMA region revenue generated from clients categorised as Professional was 65% in Q3 FY19 compared with 69% in Q2 FY19.

Year to date net trading revenue amounted to £359 million, 15% lower than in the same period in the prior year, reflecting the impact of the ESMA measures.

In terms of outlook, IG says the level of revenue in the last quarter of FY19 is difficult to predict accurately. As previously communicated, the company continues to expect that its revenue in FY19 will be lower than in FY18. The Company’s cost guidance for FY19 remains unchanged with total operating costs expected to be at a similar level to the £290 million operating costs in FY18.

The Board reiterates that the Company expects to maintain the 43.2p per share annual dividend until the Group’s earnings allow the Company to resume progressive dividends.