IG Group says all resolutions passed at AGM

June Felix was re-elected as a Director, with 96.08% of the votes cast in favor of the resolution proposing her re-election.

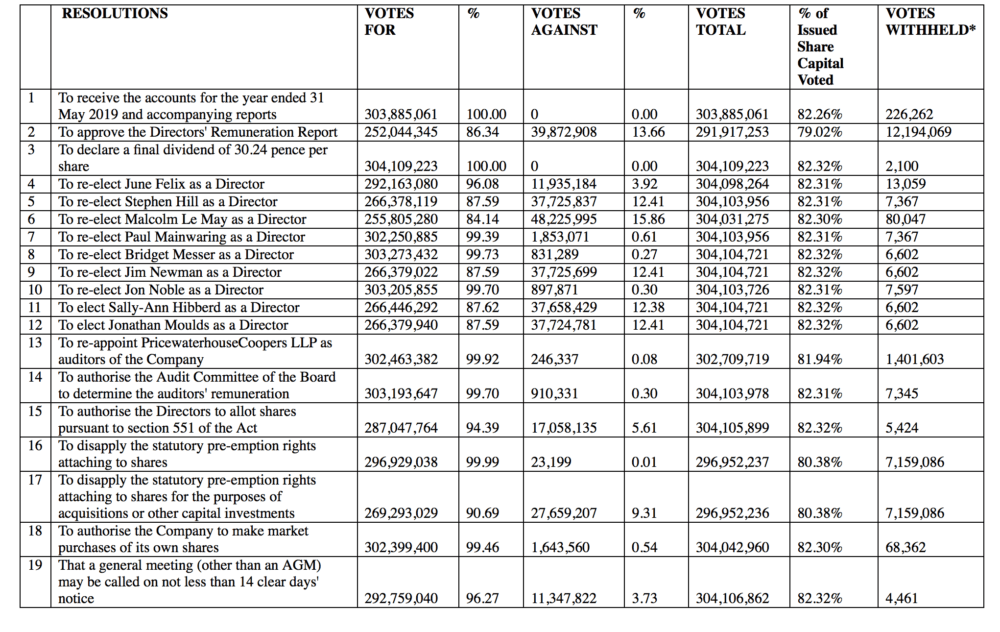

Electronic trading major IG Group Holdings plc (LON:IGG) has just reported the results of the voting at the Annual General Meeting held earlier today. At the AGM, all the proposed resolutions were duly passed.

June Felix, the CEO of IG Group, was re-elected as a Director, with 96.08% of the votes cast in favor of the resolution proposing her re-election.

Let’s recall that the list of resolutions put to vote at the meeting included (list is not exhaustive):

- To receive IG’s accounts and the reports of the Directors and the auditors for the year ended 31 May 2019.

- To approve the Directors’ Remuneration Report for the year ended 31 May 2019.

- To declare a final dividend on the ordinary shares of the Company for the year ended 31 May 2019 of 30.24 pence per ordinary share

- To re-elect June Felix (Executive Director) as a Director of the Company.

- To re-elect Stephen Hill (Non-Executive Director) as a Director of the Company

- To re-elect Malcolm Le May (Non-Executive Director) as a Director of the Company.

- To re-elect Paul Mainwaring (Executive Director) as a Director of the Company

- To re-elect Bridget Messer (Executive Director) as a Director of the Company.

- To re-elect Jim Newman (Non-Executive Director) as a Director of the Company.

- To re-elect Jon Noble (Executive Director) as a Director of the Company.

- To elect Sally-Ann Hibberd (Non-Executive Director) as a Director of the Company.

- To elect Jonathan Moulds (Non-Executive Director) as a Director of the Company

- To re-appoint PricewaterhouseCoopers LLP as the auditors of the Company to hold office until the conclusion of the next annual general meeting at which accounts are laid.

- To authorise the Audit Committee of the Board to determine the auditors’ remuneration.

These are the results of the voting:

Also today, IG updated on the search process for a new Chairman, as Andy Green has stepped down from this role. The brokerage said today a preferred candidate for the chairman’s role has been identified and the appointment is subject to securing relevant regulatory approvals. While the appointment process continues, Jonathan Moulds, an existing Non-Executive Director and Chairman of the Board Risk Committee, will be appointed as Interim Chairman.