IG lowers management fees on Smart Portfolios

The brokerage has recently reduced its management fee for IG Smart Portfolios, in order to help grow clients’ investments faster.

Online trading major IG Group has recently lowered the management fee for IG Smart Portfolios to help grow clients’ investments faster.

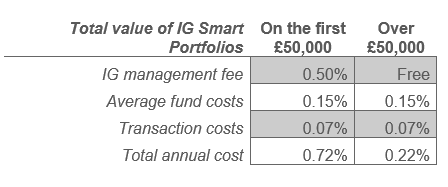

As the table below shows, the average annual total cost of owning one of IG’s portfolios is just 0.72%, and even less if one’s portfolio value exceeds £50,000 as the company caps its management fee at £250 per year.

Let’s recall that, in 2017, the brokerage partnered with BlackRock to offer savers access to a low-cost wealth management service called IG Smart Portfolios. The service is discretionary which means that IG makes investment decisions on the clients’ behalf to help grow and protect the client’s wealth over the long term. IG’s portfolio management team monitors, manages and rebalances one’s portfolio to ensure a client has the appropriate portfolio for this client’s risk appetite.

The company refers to a research finding that one of the main reasons everyday savers choose not to invest is because they believe wealth management is simply too expensive. IG found that the total cost for a ready-made portfolio across other online wealth managers is around 1.1%, with some charging over 1.8%. High fees like these hit portfolio returns.

IG’s management fee is now just 0.5% on the first £50,000 and free thereafter – meaning the maximum management fee a client pays each year is £250 per account.

There are also other costs to consider before a client invests. IG uses exchange traded funds (ETFs) and the average annual cost for the ETFs IG uses in its portfolios is currently 0.15%. Also, there is the effect of the bid-ask market spread from when IG buys and sells the ETFs used to build and rebalance a client’s portfolio, which IG estimates to be no more than 0.07% per year.

Since IG launched its range of Smart Portfolios in 2017, its portfolio performance has been really encouraging, the brokerage says.

“All of our four multi-asset portfolios have outperformed their respective benchmarks comfortably. Our Balanced portfolio, which currently invests 47% in equities, 49% in bonds and 4% in gold, has averaged +4.6% per year since February 2017, compared to +3.3% per year for its benchmark. The benchmarks we use for our multi-asset portfolios are the ARC Private Client Indices, which track net of fee performance of private client portfolios from wealth management firms such as Coutts, Schroders and Rathbones”, the company explains.

A full breakdown of IG’s performance and the performance of the BlackRock models on which IG’s portfolios are based upon is available here.

The only Smart Portfolio that has not beaten its benchmark since the product launched in 2017 is IG’s Conservative portfolio, which is very risk-averse and invests solely in cash-like securities and bonds.