IG registers 30% Y/Y drop in net profits in FY19

Profit after tax for the twelve months to May 31, 2019, was £158.3 million, down 30% from the preceding year.

Electronic trading major IG Group Holdings plc (LON:IGG) has earlier today posted its preliminary results for the twelve months to the end of May 2019, with the numbers revealing a drop in revenues and profits.

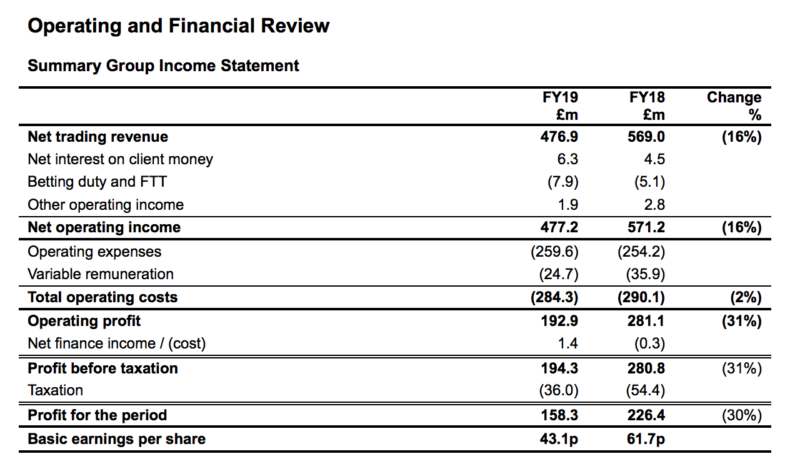

Profit after tax for the period was £158.3 million, down 30% from the preceding year.

The company said it had managed to navigate successfully through the ESMA product intervention measures which came into effect during the first quarter of the financial year. In the three quarters of the financial year during which the ESMA measures were in place throughout, 66% of ESMA region revenue was generated from professional clients.

The Group’s net trading revenue in FY19 was £476.9 million, 16% lower than the £569 million in FY18. This result is in line with previous guidance. Revenue generated from clients in the ESMA region in FY19 was 26% lower than in FY18, with 2% growth in revenue from clients in the Group’s businesses in the rest of the world.

Total operating costs for the year to May 31, 2019 amounted to £284.3 million, down 2% from the year before.

Operating profit was £192.9 million, down 31% from £281.1 million registered in FY18.

As previously disclosed, the Company expects to return to revenue growth in FY20. The revenue growth is expected to be delivered in the second half of the year as the first quarter of FY19 was only partly impacted by the implementation of the ESMA product intervention measures.

As set out in the strategy update, the Group’s operating expenses, excluding variable remuneration, are expected to increase by around £30 million in FY20. This is primarily due to additional investment in prospect acquisition, to continue to promote the IG brand, to grow the size and quality of the client base, and to establish the new businesses in the EU and the USA.

The Board reiterates that it expects to maintain the 43.2p per share annual dividend until the Group’s earnings allow the Company to resume progressive dividends.