IG tests DailyFX mobile app for Android devices

The DailyFX app is still unreleased, but it promises the “best parts of DailyFX.com” fitting in the palm of a trader’s hand.

IG Group Holdings plc (LON:IGG) has agreed the $40 million purchase of Forex news and research website DailyFX.com back in September 2016 and we have not heard much about the service ever since, apart from the recent announcement by Global Brokerage Inc (NASDAQ:GLBR) that it will stop advertising on the website. In reality, the development of DailyFX.com has not stopped. This is demonstrated by IG’s efforts to take the website closer to mobile device owners.

The list of IG Group applications on Google Play now features a DailyFX application, with the sign “unreleased” next to it. IG is asking users of the solutions to provide feedback. Throughout the trial, the company would like users to share what they’d like from the app.

The list of IG Group applications on Google Play now features a DailyFX application, with the sign “unreleased” next to it. IG is asking users of the solutions to provide feedback. Throughout the trial, the company would like users to share what they’d like from the app.

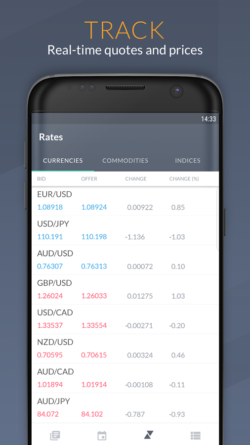

The description of the mobile solution says that the app offers “all the best parts of DailyFX.com”, fitting in the palm of one’s hand. This includes DailyFX.com’s newsfeed, market data and economic calendar.

Recently, our attention was not on IG’s mobile apps, as the company has been rolling out and enhancing its new web trading platform. The latest set of improvements to the platform about which FinanceFeeds reported last week focus on enhancing work with watchlists, signals and technical analysis. Among the new functionalities are Fibonacci extensions that have become available to the new platform charts.

In addition to that, the “Coming Soon” section of IG’s website promises the introduction of Digital100s, CFDs and Options on the new platform at some moment in the future, whereas traders are welcome to trade these instruments through IG’s mobile applications and classic platform for the time being. We have some indication about the potential launch date of options trading, as in response to a question about the availability of commodity options for trading on the new web platform, IG’s team say that the new options interface is set to be live near the end of the Summer. No firm date can be announced yet, IG says.