IG US sees largest outflow of retail FX deposits in November

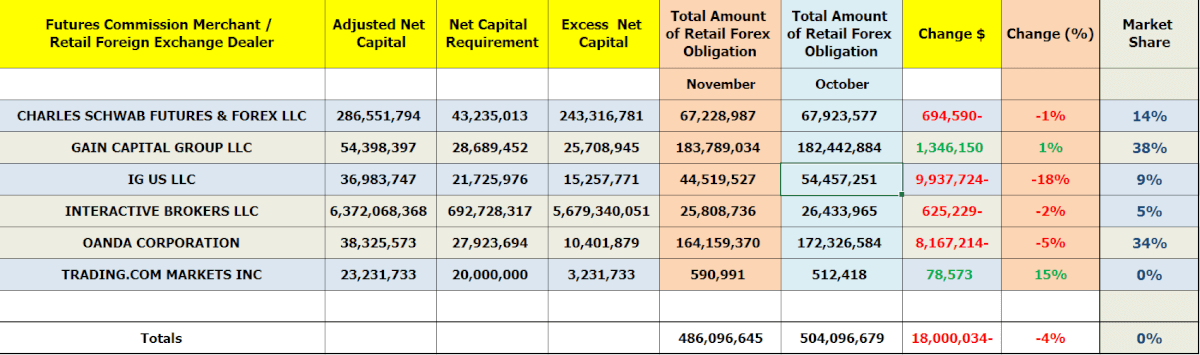

Retail FX deposits at US brokerages, which have been struggling to eke out a profit in a strict regulatory environment, dropped in November 2022 by $18 million, CFTC data showed.

The brokers, including FCMs that are registered as Retail Foreign Exchange Dealers (RFEDs) and those included as broker-dealers, saw a collective negative change in clients’ deposits month-over-month from October, though differences amongst each broker were more pronounced.

Specifically, the FX funds held at registered brokerages operating in the United States came in at $486 million in November 2022, which is 4 percent less than the $504 million reported in October.

The newest comer to the US FX industry, Trading.com Markets, continues to take a bigger chunk of the overall retail funds, but at a very limited scale. The broker racked up $590,000 in customer deposits in November, up 15 percent from just $512,000 a month earlier.

The US arm of forex brand XM provides retail foreign exchange services to US traders amid a tough regulatory environment that has squeezed other providers out of that market. Trading.com first applied for a forex broker license in the US back in January 2019. The company, however, still has a long way to go to challenge the likes of GAIN Capital and Oanda, which command nearly 70 percent of the US retail market.

Other highlights from the CFTC’s monthly report shows that Interactive Brokers LLC (NASDAQ:IBKR) has racked up $25.8 million in total deposits. This was down by 2 percent from $26.4 million in the prior month.

IG US was the worst performer for the month after reporting an overall drop of $9.9 million to $44.5 million at the end of November 2022, or a fall by 18 percent month-over-month.

After consecutive increases in its market share, Oanda also suffered a big drop in retail deposits in November 2022. Specifically, the Canada-headquartered FX broker’s net balances decreased by $8.1 million, or 5 percent, to $164 million.

Additionally, Charles Schwab reported some negative changes in client deposits, having fallen by $694K or -1 percent month-over-month.

Meanwhile in November, GAIN Capital saw a slight increase of nearly $1.3 million, or 1 percent on a monthly basis, coming in at $183.8 million.

The chart listed below outlines the full list of all FCMs that held Retail Forex Obligations in the month ending November 30, 2022. For purposes of comparison, the figures have been included against their October 2022 counterparts to illustrate disparities.