IG US widens market share as retail FX deposits hit $49M

The Commodity Futures Trading Commission (CFTC) has published its monthly report for October 2022, which covers data for FCMs that are registered as Retail Foreign Exchange Dealers (RFEDs) and those included as broker dealers that hold retail Forex obligations in the United States.

The total assets belong to the U.S. retail forex traders grew slightly in October, limited by the overall static performance seen throughout 2022. With no major changes recently noted, the sector was tracking for a stable finish this year. Yet, forex products are still a tough sale in the United States, despite the obvious benefits that a highly regulated environment can offer to traders.

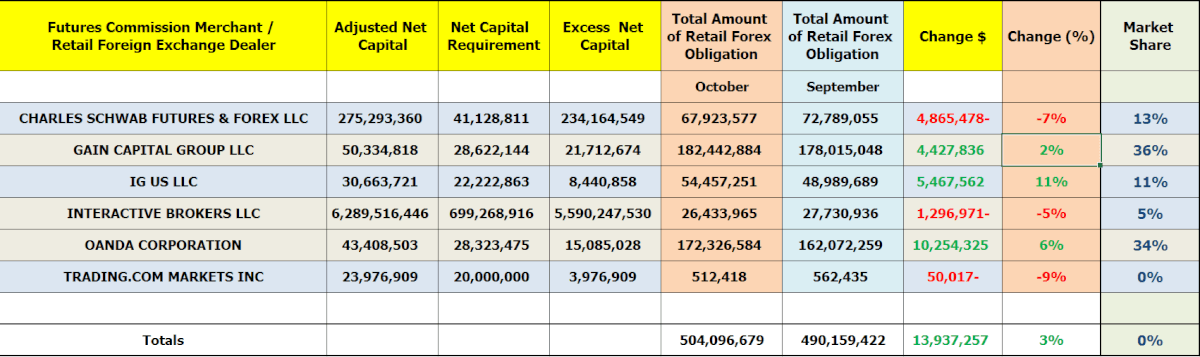

Retail forex deposits in the US have been largely skewed positively during October. The FX funds held at registered brokerages operating in the United States came in at $504 million in October 2022, which is $14 million more than the $490 million reported in September.

According to the CFTC dataset, three FX firms notched increases in Retail Forex Obligations including GAIN Capital, Oanda, and IG US. The latter was the best performer for the month after reporting an overall rise of $5.5 million to $49 million at the end of October 2022, or an increase by 11 percent month-over-month.

Other highlights from the CFTC’s monthly report shows that GAIN Capital has racked up $4.4 million in additional deposits, up 6 percent on monthly basis, to $178 million in October. Further, retail deposits at OANDA Corporation grew $10 million in October 2022, up 6 percent on a monthly basis.

The newest comer to the US FX industry, Trading.com Markets, saw its customer deposits drop to $512,000, down 9 percent from $562,000 a month earlier.

Meanwhile, Charles Schwab’ client funds were down $4.9 million, or 7 percent, from a month earlier. Interactive Brokers’ metrics were also in the red, having lost $1.3 million in client deposits to $26 million in October.

Looking at the market share of different brokers, the overall distribution saw a slight change in October relative to the month prior. GAIN Capital remained the leader in terms of market share, commanding a 36.0 percent share. OANDA also solidified its stance as the second largest in the US with 34.0 percent market share – Charles Schwab and IG US retain a 13 and 11 percent share respectively.

The chart listed below outlines the full list of all FCMs that held Retail Forex Obligations in the month ending on October 31, 2022 – for purposes of comparison, the figures have been included against their September 2022 counterparts to illustrate disparities.