IG warns of possible significant moves in end-year FX swap rates

This has been observed across the market, although some pairs are likely to be worse affected than others (most notably if one is shorting US dollars).

Electronic trading major IG Group Holdings plc (LON:IGG) is warning traders of likely significant moves in end-year FX swap rates.

Traders are advised to be aware that due to year end market factors IG is seeing significant moves in the funding rates for most FX pairs. This has been observed across the market, although some pairs are looking to be worse affected than others (most notably if you are shorting US dollars). These factors include financial institutions balancing their books before the end of the year, putting a strain on certain currencies.

Funding rates for FX pairs can be extremely volatile, resulting in one’s daily funding adjustments being much higher than normal. To the best of IG’s knowledge this will affect JPY crosses held past 10pm on the 26th December, CAD crosses and USDTRY positions held past 10pm on the 28th December, and most other pairs including gold and silver held past 10pm on the 27th December.

As an example, for a normal 2-day roll charge on EURUSD traders would receive 1.7pts for a short position and pay 1.79pts for a long position (+/- IG’s admin charge). Current rates are indicating receiving/paying 6 times these amounts should traders hold their positions through year end snapshot dates, but these rates can change.

All things being equal, the FX tradeable price should adjust to reflect these rates but the IG team notes this is out of the company’s control. The funding rates shown on the platform are indicative and subject to change.

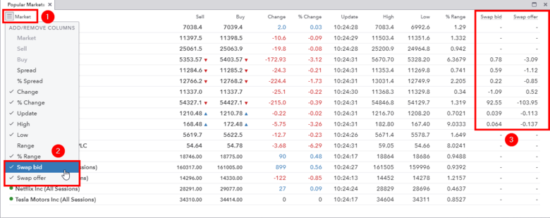

Based on client feedback IG have added overnight funding charges to the platform. Traders are advised to keep in mind that they are indicative figures. These swap rates are viewed from a watchlist. Once traders have an FX pair on the watchlist, by clicking on the three lines that are positioned on the left-hand corner next to the word ‘market’, a drop down of columns will appear. Click on the swap bid and swap offer buttons to activate them.

You can find out more about FX swap bid/offer by visiting this page.