Implementation of French binary options ad ban falls victim to bureaucracy

The lifting of the ban on 24option was announced on the next business day after the competition for the successor of AMF’s Chairman Gerard Rameix closed.

France has been touting its leadership with regard to tackling binary options fraud – its black lists of unauthorized binary options brokers are very long, and there is the Sapin 2 law that stipulates that all sorts of electronic advertising of high-risk financial products is prohibited. Recent events in the financial regulation area in France, however, stand in stark contrast to the previously trumpeted agenda against binary options.

- 24option

Today, July 3, 2017, is the day when the lifting of the ban on 24option, initially imposed in August 2016, takes effect. After mentioning the ban as one of its most significant victories against binary options firms violating the laws in almost any activity report, the French financial markets regulator decided to remove the ban and announced its decision on June 26, 2017.

The regulator said it was pleased with the measures set in place by the firm in order to remedy the situation.

Today, as the ban is lifted, the French website of 24option markets binary options and advertises the partnership of the firm with FC Juventus. These actions are in breach of the law, but the regulator has apparently turned a blind eye on them.

- The new chairman

Here comes the bureaucratic part – the new management of AMF. On June 23, 2017, the French Ministry of Economy closed the period for submitting applications for the role of Gerard Rameix, currently the Chairman of AMF. Mr Rameix is set to step down on August 1, 2017.

On the business day following the closure of the submissions acceptance period, the AMF announced the ban on 24option would be lifted. The timing suggests that AMF is reluctant to follow the policy line adopted by Mr Rameix. Apparently, now binary options brokers are back in fashion. This is a very worrisome signal about who the next AMF chairman will be and how the new management will implement (if at all) the ban on binary options advertising.

- Football

The Sapin 2 law formally puts an end to all partnerships and sponsorships that result in the advertising of high-risk financial products. The law says that such partnerships should be terminated not later than June 30, 2017, with this “grace period” applying solely to partnerships running through July 1, 2016.

That “grace period” which was incorrectly used by many binary options firms to continue to exploit the popularity of football players is now over. Are companies complying with the law now? Have they terminated this type of advertising? Have they put an end to partnerships? Short answer – no.

Apart from the stunning example of 24option, there is also the example of StockPair (see below).

- The latest data

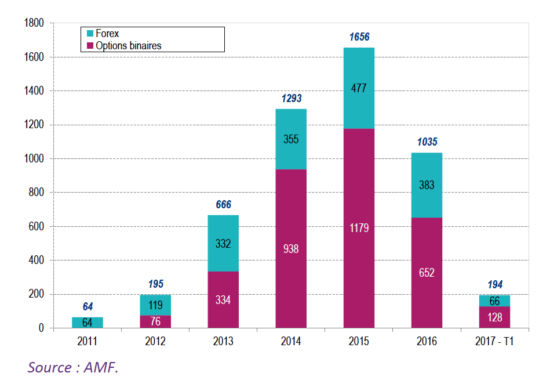

In its “Risk map for 2017”, the French regulator proudly announces that the Sapin 2 law has had a positive effect on curtailing binary options fraud. AMF says that the number of new ads on highly speculative products like binary options and Forex have dropped to 32 and 24 in February and March 2017, respectively, compared to an average of 50 per month in 2016. The regulator also happily stresses the drop in complaints about FX and binary options firms in the first quarter of 2017.

This would have been a remarkable conclusion but we should consider that a drop in the number of complaints often happens because of reluctance of fraud victims and because of the confusion and slow (often ineffective) regulatory response.