Impostors Franco Lombardo and Jordan Barta unlawfully using FXStreet brand to defraud people

FXStreet has identified that two fraudsters are claiming to be associated with the firm and sending correspondence via LinkedIn to request bank account information from individuals.

There is an old adage that infers that imitation is the greatest form of flattery.

In some cases, however, imitation is absolutely the opposite.

This week, FXStreet CEO Carolina May has identified two impostors who are, according to her statement, making attempts to dupe people out of money by falsely stating that they represent FXStreet.

FXStreet is a long-established and highly reputable news source, used by many retail traders globally, that provides news and real time FX market analysis, exchange rates, charts and an economic calendar, along with important industry-related news.

It has vast coverage and is well recognized among all sectors of the FX industry, therefore these two individuals, who are completely unrelated to FXStreet, can easily misuse the name in order to appear that they are offering a reputable service.

Ms. May stated this morning “Please be aware as there is an individual under the names of Jordan Barta and Franco Lombardo trying to collect people’s money using our renowned brand. These individuals never worked nor collaborated with FXStreet.”

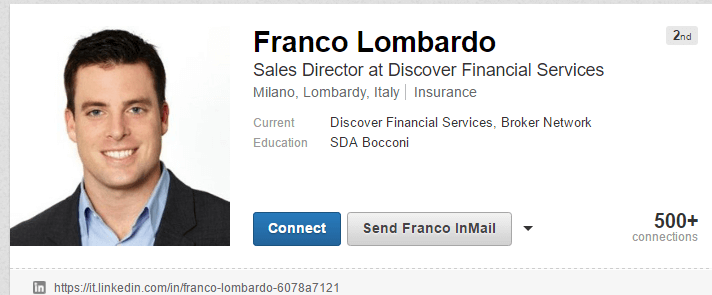

Mr. Lombardo’s LinkedIn profile shows that he is Sales Director at Discover Financial Services, and that he is based in Salt Lake City, Utah, whereas his summary states that he is based in Italy.

He makes references to FXStreet and has a listing on his LinkedIn profile that states that he is associated with FXStreet.

The LinkedIn profile of the other individual, Jordan Barta, has been removed.

According to FXStreet, the majority of the unlawful solicitations were made via LinkedIn in which the two impostors sent correspondence to individuals, asking them to provide bank details and personal information before signing the correspondence under their names as representatives of FXStreet.

Featured image: FXStreet CEO Carolina May.