Institutionals have figured out Crypto: NDFs are the way to go

“Given their OTC nature, NDFs are much easier to manage (e.g., there are no margin issues with exchanges) and the technology and risk management philosophy is extremely well embedded into the current setup across all banks.”

Coalition Greenwich, a division of CRISIL, has recently published a research study on the road ahead for cryptocurrencies.

Between July and October 2021, the research firm conducted 108 interviews across a spectrum of cryptocurrency users, including senior trading personnel at some of the largest cryptocurrency derivatives market makers.

The goal was to understand the market’s view on the transition cryptocurrencies are making from the physical context to the financial.

The study, “Cryptocurrencies: The Road Ahead May Not Be Cryptic Anymore“, reveals many findings such as that non-deliverable forwards (NDFs) are increasingly being repurposed as a vehicle to support institutional buy-side interest in digital assets.

“As cryptocurrency moves from a largely retail product at the edges of the market place to a product that engages a broad set of institutional investors across the financial markets, impediments to wider use will have to be solved. From the unknowns of the regulatory landscape facing the physical market to the challenges of adopting and fitting new technology into the existing tech stack and operational processes, financial institutions are looking to play a larger role in these markets and drive product innovation to surmount these issues”, the firm stated.

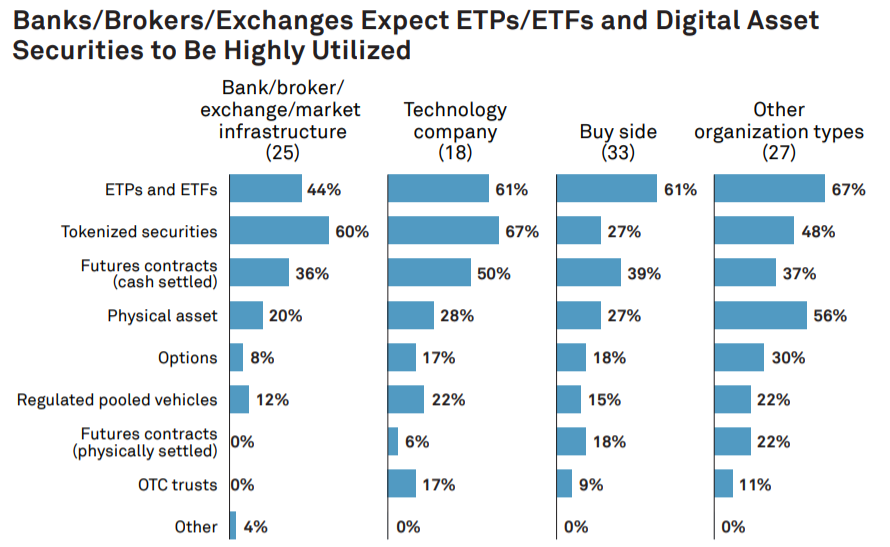

“Derivative products, which have a long track record and are easy to understand and transact, were naturally the first to be utilized to get exposure to the crypto market—namely futures and exchange-traded products (ETPs). However, they come with their own unique challenges that prevent wide adoption in the short term”.

The paper covers the evolution of derivative and synthetic instruments that can help ease the transition of cryptocurrencies into the mainstream.

“Given their OTC nature, NDFs are much easier to manage (e.g., there are no margin issues with exchanges) and the technology and risk management philosophy is extremely well embedded into the current setup across all banks.

“All study participants expressed deep familiarity with the instrument, and it is clear that once they receive internal approval, all large LPs would be able to hit the ground running and make markets. Beyond this, the product provides flexible access 24 hours a day and has the ability for contracts to expire on bespoke days, which further contribute to its attractiveness”.

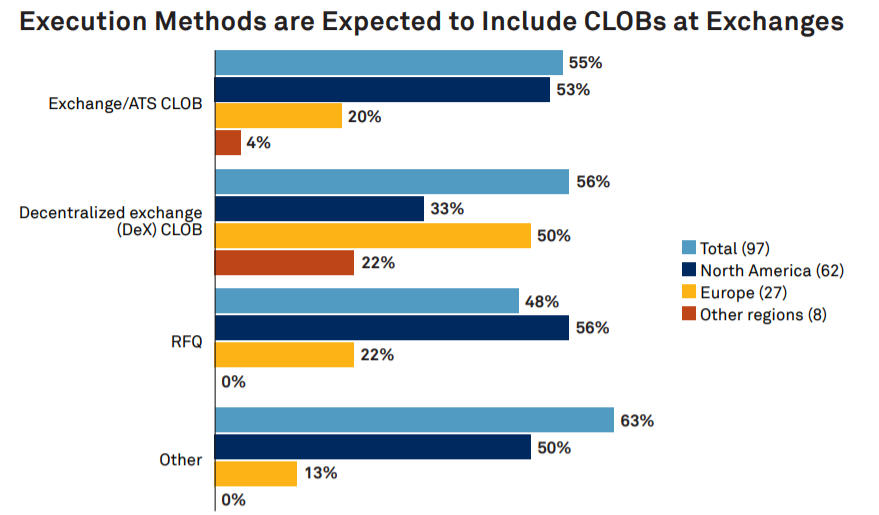

As to challenges to wider NDF adoption, the paper found participants rather trade crypto on CLOBs (central limit order books) and exchanges.

“Given the nascent nature of the underlying and the volatility of cryptocurrencies, we believe that the market will see a move to multilateral venues or an aggregated CLOB before bilateral trading takes off in earnest”, the firm continued, pointing to 24Exchange as one of the pioneers in crypto NDFs.

“The advantage of this option for bank LPs is that the rate is created by a reputable third party and is easily observable. The challenge participants face is that this fix is not tradable, thereby leaving residual risk in the books.”

A few Liquidity Providers pointed to one early potential downside of NDFs: the ability for nonbank LPs to quickly move into the vanilla NDF space once the product is established, which will lead to better liquidity but tighter spreads.

“As a result, these bank LPs are looking beyond vanilla, short-dated NDFs, aiming to use those primarily as building blocks to offer options and longer-dated contracts to differentiate their product offering from the nonbanks, while retaining more

robust margins on their activities”.