Integral reports lowest FX volume in two years

Foreign exchange trading volumes dropped in November across Integral’s trading platforms as currency markets saw a relatively quiet period after consecutive months of strong trading activity.

Integral said that the average daily volumes (ADV) across its platforms totaled $42.6 billion in November 2022, which was the lowest reading in more than two years, namely since October 2020. The figure dropped 7 percent over a monthly timeframe, compared to $45.7 billion in October 2022.

Additionally, November volumes were below those reached in the same month a year ago. Specifically, the latest figures reflect a 16percent increase when weighed against the metrics of November 2021.

Reported ADV represents volumes traded across the group’s entire liquidity network, including TrueFXTM and Integral OCXTM.

Earlier in November, Integral has announced a long-time partnership with online brokerage group Capital.com, which allows the latter to use Integral’s cloud-based FX workflow automation technology.

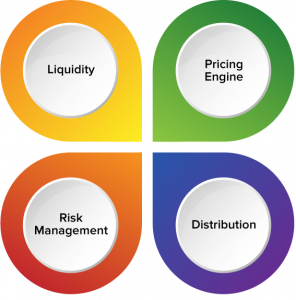

Dubbed ‘IntegralFX,’ the in-house solution enables Capital.com to offer bank-grade pricing to their retail trader customer base. Many brokers already tap Integral’s pricing engine infrastructure to facilitate the creation and distribution of many products for each of the customer groups. This allows them to incorporate CFD products and centralize their leveraged products through one provider.

Integral’s end-to-end eFX trading and workflow solution has been specifically built for the broker community. The company’s SaaS technology, available at a fixed subscription cost, enables platforms like Capital.com to focus on growing their business without worrying about additional brokerage fees.

Capital.com will also benefit from connectivity to Integral’s low-latency market data, greater access to multi-asset liquidity sources, and advanced price distribution functionality.

On the technology side, Integral has recently upgraded all aspects of the technology stack for its relationship-based trading platform, FX Inside (FXI). The upgraded FX Liquidity aggregation solution addresses the business needs of brokers, banks, institutional and algorithmic trading clients. Specifically, the web-based trading solution is now available through HTML5 browser and mobile devices, and it enables users to offer a single dealer platform (SDP) to their customers.

This actually catches up with a major shift occurring in the FX market demand for SDP platforms driven by customers’ need for asset class diversification, post-trade support, research and market data.

A cloud-based environment included in the solution allows for complete customization, as well as RFS and ESP trading in spot, outrights, swaps, NDFs, precious metals and CFDs.

Furthermore, Integral deployed the latest FX Inside technology within its Open Currency Exchange (OCX), an FX ECN that connects to over 250 liquidity sources including banks, brokers and asset managers. The OTC venue supplies more than 3,000 market-making streams in NY4, LD4, and TY3.