Interactive Brokers adds auto-restart feature to TWS platform

The functionality will restart the application throughout the week and only requires a manual restart and authentication once per week, each Sunday.

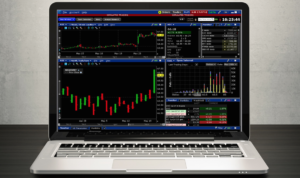

Electronic trading major Interactive Brokers Group, Inc. (IBKR) continues to bolster the functionalities of its TWS trading platform. The latest beta version of the solution allows traders to set the platform to auto restart.

Both TWS and the IB Gateway require daily restarts to refresh data. As a convenience, Interactive Brokers now offers an auto-restart feature that will restart the application throughout the week and only requires a manual restart and authentication once per week, each Sunday.

There are several factors outside the control of Interactive Brokers that may impede auto-restart:

- If a trader’s machine is in sleep or hibernation mode, or happens to have no power when the restart is scheduled to occur.

- If a trader’s machine is installing operating system updates that trigger an automatic system restart when complete.

- In rare cases, for example for security reasons, IBKR may need to revoke the authentication token, causing the platform to require manual authentication.

Users are advised to take into account that auto-restart works best with offline versions. In other TWS versions, a failure of the automatic update, such as a network issue or failing to write on the disk, may result in an interruption of the automatic restart.

The brokerage warns that by having the trading platform constantly up and running exposes it to the risk of being accessed by unauthorized persons. That is why, Interactive Brokers strongly recommends that traders consider the following security measures:

- Use a higher level of access control and protections for the operating system account profile, the physical machine running your trading platform, and the premises where it is located.

- Keep the account protected with two-factor authentication; either the Secure Login System (SLS) devices or the IBKR smartphone application.

Let’s note that this beta version of the TWS platform introduces enhancements to the search process. Thanks to the new auto-complete “Search” fields included on menus, in the New Window drop-down, and in the right-click menu from any symbol in your Watchlist, Portfolio or trading page, now it has become easier to access the tools and information one needs within TWS. Traders can avoid navigating through multiple layers of menus by simply typing what they need in the relevant search field and clicking the desired result to load the tool or window they need.

Traders can click the Mosaic Account menu, and instead of navigating down to Activity and then to Activity Statements, they can simply start typing “Activity” in the Search box. They can then go to their Watchlist or Portfolio and right-click an instrument. Instead of navigating down to Charts and then New Chart, they may just start typing “chart” in the Search box.