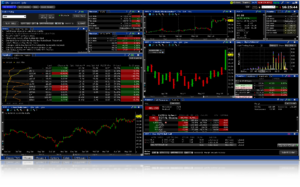

Interactive Brokers adds new Scanners & Columns from AltaVista Research, Recognia to TWS

Interactive Brokers bolsters the research and technical analysis capabilities of its TWS platform by adding new tools from AltaVista Research and Recognia.

Interactive Brokers Group, Inc. (NASDAQ:IBKR) continues to enhance TWS, with the set of novelties available in the latest beta version of the trading platform including new scanners and columns from AltaVista Research and Recognia.

Those of you who are familiar with exchange traded funds (ETFs) have probably heard of AltaVista Research – a company that was founded in 2004 to provide research on ETFs. AltaVista’s approach to analysis is to evaluate ETFs based on the fundamentals of each underlying constituent, so that investors can gets the answers to important questions before buying a stock or bond, like “What are expectations for earnings per share growth?”.

Now, IB TWS offers AltaVista Research-powered ETF market scanners and columns. The new ETF Market Scanner enables traders to easily find ETFs. Filtering and scanning of 1,400 US Equity and Fixed Income ETFs is possible by using the numerous (over 30) data points provided by AltaVista Research. These include Assets Under Management, Expense Ratio, Year-to-date, Developed Market Exposure, Payout, Forward Price/Cash Flow, Long Term Growth, Short Interest, etc. In addition, traders can add ETF-based columns to any tool.

Regarding Recognia, the company is known as an expert in quantitative and technical analysis. It provides research on stocks, options, ETFs, indices, FX, commodities and futures.

Now, IB TWS offers Recognia Research technical indicator scanners and columns.

Recognia’s pattern recognition technology identifies technical events that may indicate the short-term, mid-term or long-term trends. Traders can apply technical pattern scanning with other fundamental and technical data points to find the stocks that match their specified criteria. Recognia can recognize more than 60 technical events, like Head and Shoulders, Breakouts, Shooting Stars, Hammers and Gravestones.

Traders can also add Recognia Research-based columns to any tool.