Interactive Brokers beefs up offering to institutional clients with new Pre-Trade Compliance Tool

The tool enables advisors, brokers, hedge fund investment managers, proprietary trading group master account users and compliance officers to apply trade-related restrictions to an account, a user or a “family” of accounts.

Interactive Brokers Group, Inc. (NASDAQ:IBKR) is expanding the offering to its institutional clients via the recent addition of a new Pre-Trade Compliance Tool to its growing suite of compliance tools and support functions.

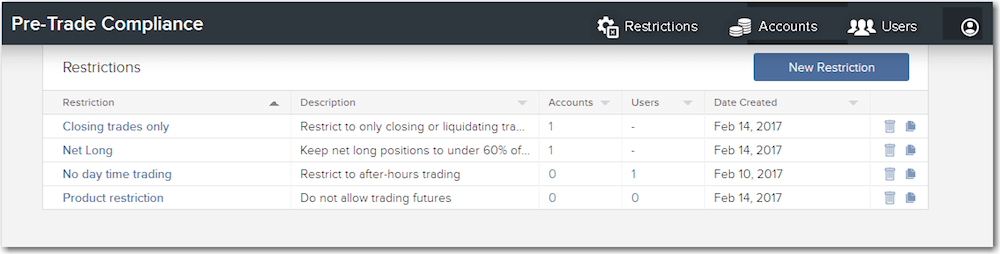

The purpose of the Pre-Trade Compliance Tool is to enable advisors, brokers, hedge fund investment managers, proprietary trading group master account users and compliance officers to apply trade-related restrictions to an account, a user or a “family” of accounts, that is, all client and sub-accounts. Pre-Trade Compliance replaces all trading restrictions previously available in Account Management and EmployeeTrack Management.

Each restriction rule presents metrics and settings used to define the threshold at which an order will be rejected. Putting it otherwise, restrictions are composed of one or more rules, and each rule specifies some kind of threshold or boundary that will result in an order rejection when breached. In case a restriction includes multiple rules, violation of any rule will lead to the order being rejected.

Adding rules is the second step of creating a restriction, with a variety of rules available. For instance, a “Net margin” rule means setting a threshold for Excess Liquidity or Margin (via the Margin Cushion metric). Any order that would cause the selected metric to fall below the specified threshold will be rejected.

To open Pre-Trade Compliance, Log into Account Management > From the Manage Account menu, select Trade Configuration and then select Restrictions. One can also access this feature via the Manage Clients/Funds/Traders menu by selecting Trading and then Restrictions.

Compliance Officers can also make use of the Pre-Trade Compliance tool. They can launch it from the Manage Employees > Trading Restrictions page in EmployeeTrack Management.

Among the novelties with regards to account management, Interactive Brokers has announced the Beta release of its new Account Management system. The company has rebuilt Account Management, which now offers simplified access to a variety of functions thanks to the new menu. Clients can access all account and user settings from two simple screens, whereas statements, trade confirmation reports and flex queries are available from a single screen. Clients with several accounts can take advantage of the new intuitive account selector that aims to make it easier to find and choose linked and partitioned accounts.

The Beta version is launching with 80% of existing Account Management functionality available, and the company expects to complete the remainder by September. For advisors, brokers and other institution accounts, the Dashboard for client management will not be immediately available. In the autumn, Interactive Brokers plans to launch an entirely new combined Dashboard and Customer Relationship Manager (CRM) interface for client management from a desktop as well as mobile devices.