Interactive Brokers’ CEO Thomas Peterffy to be paid salary of $800,000 in 2019

This amount reflects the intention to set a salary level safely below the cap as calculated for 2018.

Electronic trading major Interactive Brokers Group, Inc. (IEX:IBKR) has published a SEC filing regarding its 2019 Annual Meeting of Stockholders, set to be held on Thursday, April 18, 2019 at 9:30 a.m. Eastern Time, at 432 Park Avenue, New York, NY 10022.

The items of business to be put to vote include the election of eight directors to the Board of Directors to serve until the annual stockholders’ meeting in 2020, and until their respective successors have been elected and qualified. Another item is to hold an advisory vote on executive compensation.

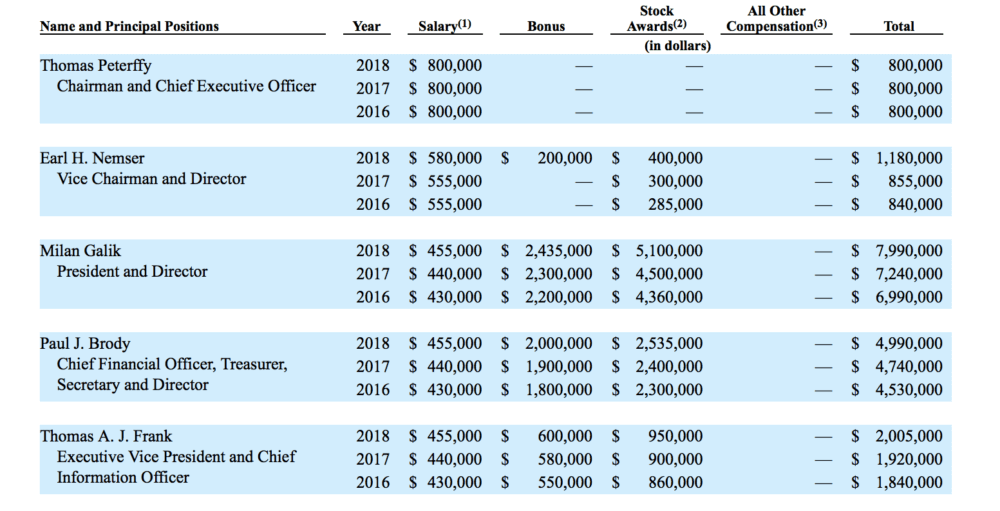

The document includes a very detailed explanation of the executive compensation for 2018.

Historically Mr Thomas Peterffy, Interactive Brokers’ Chairman and Chief Executive Officer, has ultimately determined compensation for all employees. He has traditionally set his own compensation as salary, capped at 0.2% of IBG LLC’s net income. During 2018, Mr Peterffy was paid a salary of $800,000 by IBG LLC and no bonus in accordance with historical practices.

With the intention to set a salary level safely below the cap as calculated for 2018, during 2019, Mr Peterffy will be paid a salary of $800,000 by IBG LLC. The company believes that the ownership by Mr Peterffy and affiliates, through ownership in Holdings, of a significant amount of the equity in IBG LLC aligns his interests with those of Interactive Brokers common stockholders.

In early January this year, the brokerage unveiled changes concerning its top management. Back then, Interactive Brokers said Milan Galik will succeed Thomas Peterffy in the role of CEO. Mr Peterffy will continue as Chairman of the Board and remain closely involved in the operations of the company that he founded.

On January 22, 2019, Interactive Brokers’ Board of Directors formalized the changes at the top by appointing Milan Galik to serve as the Company’s Chief Executive Officer effective October 1, 2019.

Interactive Brokers explains that, in 2018, Mr Galik in his role as President continued to play a key role in the management of the Company and in the development of software and systems for Interactive Brokers’ electronic brokerage platform, driving growth in this segment. Mr Galik’s performance and contribution to the achievement of the Company’s financial goals, as well as his role as President, merited a higher bonus in 2018 than the other executive officers of the Company, in the determination of the Compensation Committee. Mr Galik is expected to receive an award under the Stock Incentive Plan in 2019 based on his anticipated future contribution to Interactive Brokers’ success.