Interactive Brokers enhances security features of IBKR Mobile app

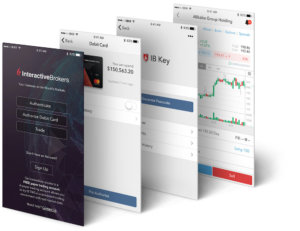

The new IBKR Mobile app combines IB TWS for Mobile and the IB Key security protocol into one app that lets traders securely manage their account and trade.

Online trading major Interactive Brokers Group, Inc. (NASDAQ:IBKR) has enhanced the security functionalities of its mobile application. The latest versions of the solution, which has been renamed as IBKR Mobile, combines IB TWS for Mobile and the IB Key security protocol into one app that lets traders securely manage their accounts and trade.

Thanks to the upgraded solution for iOS and Android devices, traders can keep their accounts safe by applying IB Key two-factor authentication when logging into any of Interactive Brokers’ websites or trading platforms.

In addition, traders get to manage their IBKR Debit Mastercard – authorize transactions, pre-authorize large-purchases and lock and unlock their debit card right from their phone.

The latest version of the app offers new options tools. For the iOS version of the solution, such a new tool is the Option Exercise screen which is accessible from the Trade section of the More menu. View all available long and short equity option, future option and warrant positions. Positions marked with a “zig zag” icon should be considered as candidates for early exercise. Tap a contract to view details, tap again for extended Quote Details that now includes more detailed market and positions information.

For the Android version of the app, the latest options tool is called Spread Template. It makes it easier to create a complex multi-leg spread by providing a pick list of the most used strategies. In addition to the helpful pick list, the Spread Template intuitive grid display:

- Lets traders quickly compare prices across a range of similar combinations and quickly pick the one you want.

- Enables traders to quickly compare tightness of the bid/ask spread for multiple strategies and quickly pick the one with the best spread.

- Helps traders quickly search for the most appropriate strategy to hedge an existing position via Delta and Gamma display in each grid box. Each grid displays key information such as delta and gamma, and traders can fine-tune grid strategies by adjusting filters.

To use a Spread Template, one should open Quote Details for an instrument and tap “Spreads” from the top row of access buttons.

Let’s note that the apps for iOS and Android devices offer easier access to Account Management.