Interactive Brokers introduces Bond Scanner

The Bond Scanner aims to make finding the best prices on bonds easier and more transparent.

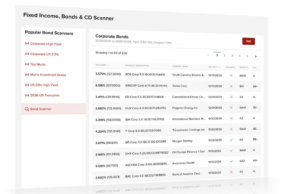

Online trading major Interactive Brokers Group, Inc. (NASDAQ:IBKR) today announced it has launched a Bond Scanner to make finding the best prices on bonds easier and more transparent.

Interactive Brokers offers a variety of fixed income products, including a range of US government securities, over 38,000 global corporate bonds, 851,000 million municipal securities, 33,000 CDs, 1,900 non-US Sovereign bonds, plus fixed income futures and fixed income options. Interactive Brokers uses sophisticated technology to connect its Trader Workstation platform (TWS) with multiple leading electronic bond trading venues including BondDesk, Knight BondPoint, MuniCenter, NYSE BONDS and Tradeweb.

The Bond Scanner enables:

- Searching for a maturity date range and locate bond yields.

- Scanning for Corporate bonds by industry or by state for Municipal bonds.

- Defining values for minimum and maximum yield-to-worst.

- Defining high yield or investment grade universe of bonds.

- Using of Moody’s and S&P ratings filters to evaluate risk vs. return.

- Quickly scanning Corporates, CDs, Treasuries and Municipal bonds by clicking “bond type” button.

Investors can search and compare available yields against those of other brokers. For corporate bonds, investors can simply enter a suitable maturity date range into the scanner and click View Results to browse availability. Clicking the Yield or Maturity column headers will sort search results. IBKR clients can enter orders and interact with each other by posting bids and offers.

Investors can fine tune the bond scanner by selecting specific industries and defining values for minimum and maximum yield to worst. Define the results by high yield or investment grade or simply choose all bonds. Moody’s and S&P Ratings filters let investors evaluate risk versus return and they can quickly scan within CDs, Treasuries and muni bonds by selecting the bond type buttons at the top of the scanner.

The company encourages its clients to make their own bids or offers for issues of interest.

In addition, Interactive Brokers has the ability to cross orders in TRACE eligible and certain non-TRACE eligible corporate bonds internally on its integrated ATS if clients post better bids or better offers on the platform than in the market, improving the chances of a favorable fill.