Interactive Brokers introduces MidPrice order type

The brokerage introduces the MidPrice order type for smart-routed stock orders.

Online trading major Interactive Brokers Group, Inc. (IEX:IBKR) is launching a new order type. The latest release notes concerning the TWS platform include an announcement about a MidPrice order type.

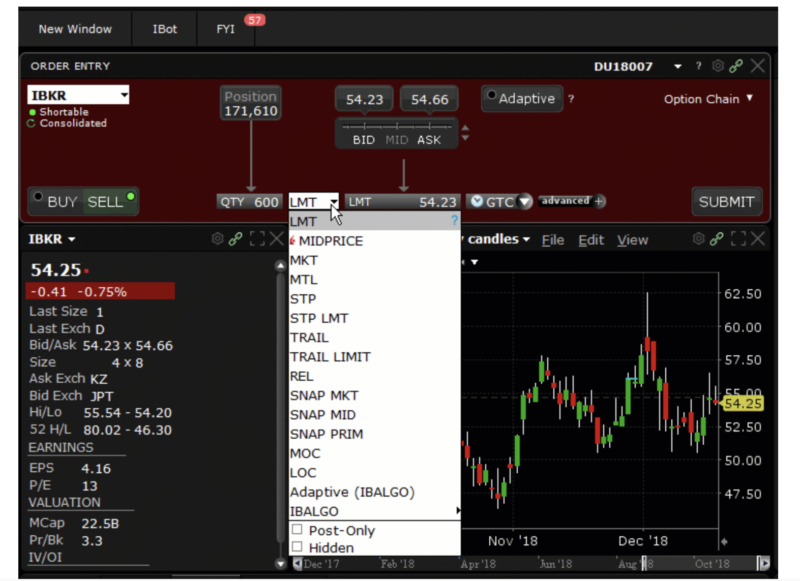

The brokerage introduces the MidPrice order type for smart-routed stock orders. MidPrice is designed to split the difference between the bid and ask prices, and fill at the current midpoint of the NBBO – or better. To create this order, users of the TWS platform have to choose MidPrice from the order entry Order Type field. Set an optional Price Cap to define the highest (for a buy) or lowest (for a sell) acceptable price for the order.

To achieve the midpoint price or better, the MidPrice order is routed to the exchange with the highest probability of filling as a Pegged-to-Midpoint order, or in the case of IEX as a Discretionary Peg (D-Peg) order. If no such exchange is available, the MidPrice order is routed as either a native or simulated Relative order.

Recent improvements to the TWS platform also include an enhanced Quote Details window.

The enhanced Quote Details window has:

- More data, including Comparison to Historical, Comparison to Peers and Scanner Results;

- Provides a more vibrant, graphical display that’s easy to read;

- Is context-sensitive to show instrument-relevant data. It will display different information for ETFs than it will for stocks or for bonds.

On top of that, the enhanced Quote Details summarize key data from different TWS tools, then provide a link from that data to launch the relevant tool.

Other novelties in the TWS platform include new Pivot Point studies and more period selections available in charts. This version of the platform also enables increasing trading speed by creating custom Market Depth Trader order buttons. These buttons are available for all instruments, for a specific asset type, or even for a specific instrument.