Interactive Brokers introduces further search enhancements to TWS platform

Traders can avoid navigating through multiple layers of menus by simply typing what they need in the relevant search field.

Electronic trading major Interactive Brokers Group, Inc. (NASDAQ:IBKR) has made further improvements to the search process in the latest version of its TWS platform.

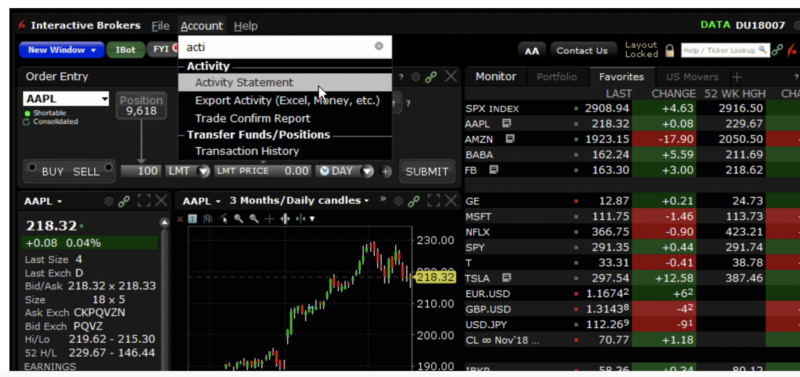

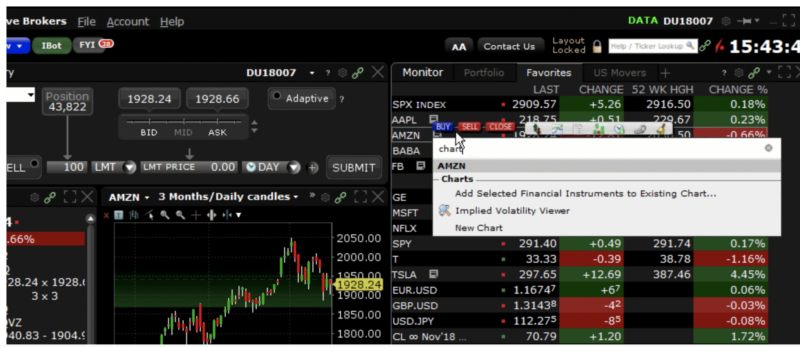

Thanks to the new auto-complete “Search” fields included on menus, in the New Window drop-down, and in the right-click menu from any symbol in your Watchlist, Portfolio or trading page, now it has become easier to access the tools and information one needs within TWS. Traders can avoid navigating through multiple layers of menus by simply typing what they need in the relevant search field and clicking the desired result to load the tool or window they need.

Traders can click the Mosaic Account menu, and instead of navigating down to Activity and then to Activity Statements, they can simply start typing “Activity” in the Search box.

They can then go to their Watchlist or Portfolio and right-click an instrument. Instead of navigating down to Charts and then New Chart, they may just start typing “chart” in the Search box.

Other recent search enhancements in TWS may be tested by clicking the New Window icon in Mosaic. The cursor opens in the new Search field. Simply enter a tool or feature name, like “options” or “Advanced Market Scanner”. As traders start to type, the list of tools updates to fit their search, based on both the title and the feature itself. For example, typing “options” will not only return “Option Chains” and “OptionTrader,” but also “Implied Volatility Viewer” and more, all of which are option-centric tools. When traders see the tool they would like to use, they simply have to click to open.

The latest (beta) TWS version also offers improvements that are aimed at Advisors managing a large number of accounts. The broker has streamlined the process for handling allocation orders. This new process will result in changes in both TWS and the API (when used with TWS version 974 or greater).

In the TWS platform, in the Trade Log, Advisors will (by default) see a summary of the allocated orders. They can expand the summary to see partial fills and allocations for that order.

When exporting FA allocation orders, only trades for the master account will be exported. Allocation details can be exported by selecting the individual account in the Trade Log first.

The broker notes that commissions for allocation transfers can also be viewed when the individual account is selected in the Trade Log window.