Interactive Brokers invites traders to check out mobile apps’ Event Calendar feature

The feature allows traders to view Corporate Earnings and Events, Economic Events, Dividends, Splits and IPO/Secondary Offerings.

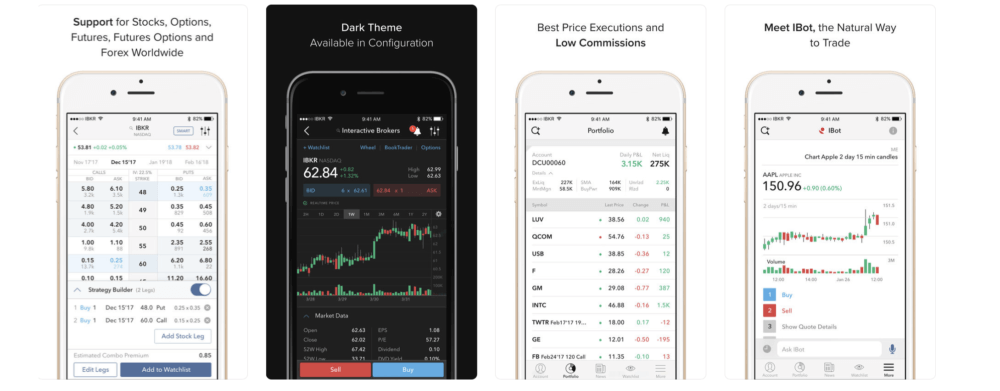

As the client base of brokerages becomes increasingly attracted to mobile technologies, it comes as no surprise that online trading services provider Interactive Brokers Group, Inc. (IBKR) continues to enhance the functionalities of its mobile applications.

The company now invites traders to check out the Event Calendar feature, which is available on the IBKR Mobile app for iOS and Android-based gadgets. The mobile calendar enables traders to view Corporate Earnings and Events, Economic Events, Dividends, Splits and IPO/Secondary Offerings.

The general calendar can be accessed from the More menu, whereas an instrument specific calendar can be enabled on the quote details page and can be moved to a convenient location.

Last month, the app gave traders the ability to stream live Bloomberg TV thanks to the new Media tab. It is available in the News/Media tool, along with Portfolio news. In addition, advisors got to see complex, multi-leg positions in their portfolio.

Trades display has also been beefed up, as traders can now view up to seven days of trades (instead of just today’s trades) on the Trades screen.

The version of IBKR Mobile for Android gadgets which was released in August introduced improvements to Order Entry. Users of the solution got the ability to quickly access Order Entry or view their orders and trades with the new Trader Launchpad button. When traders tap the round, green icon from the Watchlist or Portfolio screen, they can then choose to create a buy or sell order, search a quote, or see details for recent quotes. Also, a new section in Order Entry shows the account’s Buying Power and asset position.

Talking of improvements introduced to Interactive Brokers’ trading platforms, let’s recall that the latest (beta) version of TWS has switched to a new Mark Price Implied Volatility (IV) calibration method. The more precise method provides a better and more comprehensive volatility surface. This results in improved model price and Greeks in TWS especially for deep in-the-money or far out-of-the-money options.

Traders can see the applied IV skew curve in the Implied Volatility Viewer – they just have to use the Search field in the Mosaic New Window drop-down to find the tool.