Interactive Brokers iPhone app enables depositing of checks

Traders need to snap a picture of the front and back of the check and enter the amount.

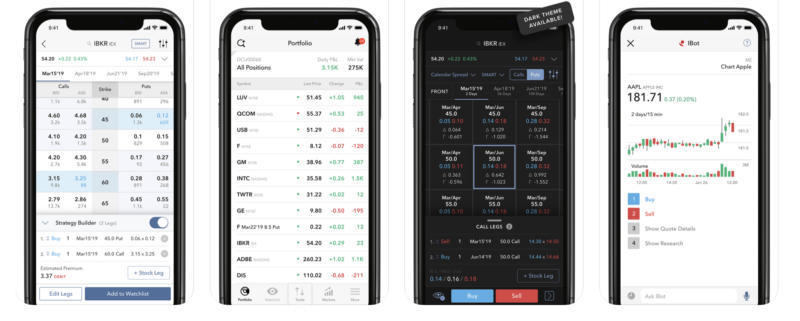

Online trading major Interactive Brokers continues to boost the capabilities of trading solutions, with the latest set of enhancements concerning the IBKR mobile app for iOS devices.

The latest version of the solution enables users to deposit checks via their mobile phones. All a user has to do is snap a picture of the front and back of the check and enter the amount. The brokerage notes that this feature is currently available in the United States only.

In the preceding version of the app, Interactive Brokers introduced a new homepage. The new Mobile Homepage consolidates key account, position and market updates, plus quick access to “For You” account-related notifications, all in one place. Traders are now able to launch trading tools and view details from each widget. One can open the Homepage at any time from the menu.

The brokerage has recently enabled fractional share trading and gave traders the ability to enter order size in terms of dollar amounts via the mobile app.

When using a Cash Quantity order, users specify the dollar amount they want to buy or sell instead of specifying the number of shares. Rather than buying five shares they elect to buy, for example, $500 worth of a stock. Then they purchase the equivalent number of shares for that value rounded down to the nearest whole share.

If traders enable their account to Trade in Fractions, the brokerage will buy or sell a fraction of a share to use the full amount of cash the traders specified and get the greatest possible number of shares for their money.

To enable fractional share trading, log into Client Portal and from the Settings menu select Account Settings. Click the gear icon next to Trading Experience & Permissions and expand the Stocks section. Check United States (Trade in Fractions).