Interactive Brokers launches Advisor Portal

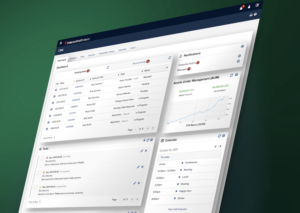

Advisor Portal is Interactive Brokers’ new turnkey account management platform enabling advisors to manage clients and prospects.

Online trading services provider Interactive Brokers has recently launched the Advisor Portal, its new turnkey account management platform enabling advisors to manage clients and prospects.

Advisor Portal includes a free Customer Relationship Manager to manage the full client acquisition and relationship lifecycle. The CRM provides access from any desktop or mobile device, as well as the ability to store, view and update information about contacts, and easily manage funding transactions. Advisors can also manage client relationships with emails, notes, agendas, tasks, calendars and more. Advisors are also enabled to “drill down” to each client to set fees, view portfolios and run reports. They can also delegate user access rights by function and client account.

Advisor Portal is free to any advisor on the IBKR platform and includes access to PortfolioAnalyst, Interactive Brokers’ full-feature portfolio management system that easily consolidates information from any financial institution to help measure investment performance and risk. PortfolioAnalyst enables advisors to oversee clients’ accounts and manage investor outreach and engagement, as well as to monitor performance and distill portfolio level data to drive client engagement.

Advisor Portal also includes features for client notes, email, tasks and a calendar, and is mobile-friendly to let advisors manage clients from any desktop or mobile device.

Advisor Portal supports advisors of all sizes and can be branded with a firm’s distinctive identity.