Interactive Brokers Loses $6 Million in Retail FX Deposits

The Commodity Futures Trading Commission (CFTC) has published its anticipated monthly report for July 2021, which covers data for FCMs that are registered as retail foreign exchange dealers (RFEDs) and those included as broker-dealers that hold retail forex obligations in the United States.

The latest data shows a total negative change month-over-month from June, though differences amongst each broker were more pronounced. With no major changes recently, the sector is tracking for a subsided entry into the third quarter.

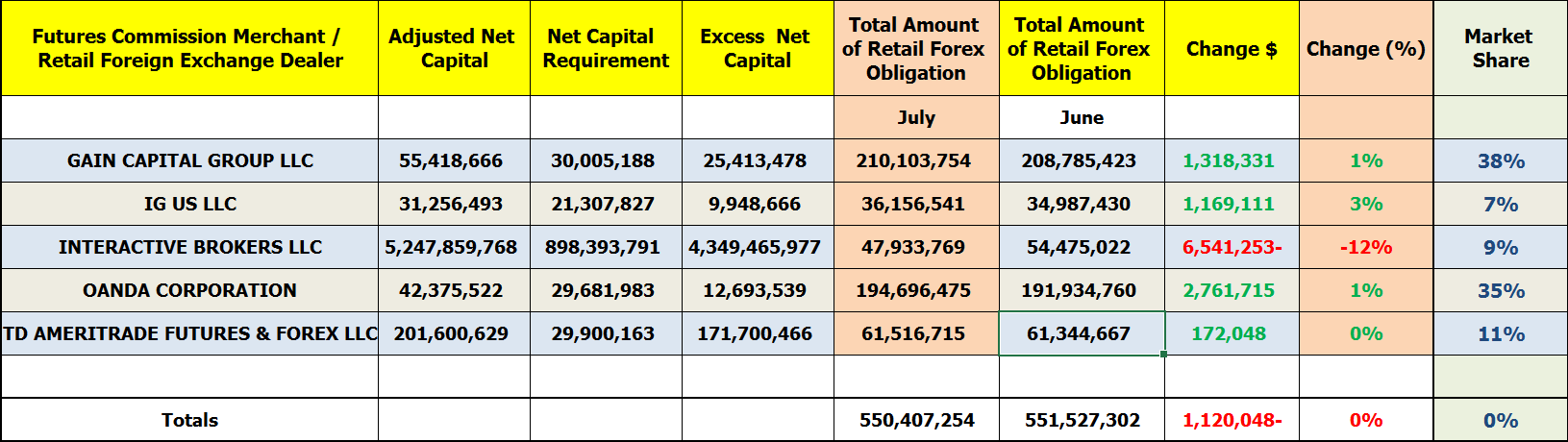

Overall, the FX funds held at registered brokerages operating in the United States came in at $550 million in July 2021, which is less than the $552 million reported in June.

Four of the five FX firms listed notched increases in their respective retail forex obligations. The best performer was IG US, which saw its clients’ assets grow by $1.16 million, or nearly three percent month-over-month.

The US subsidiary of the London-based spread better continues to take a bigger chunk of the overall retail funds, after racking up $35 million in customer deposits in July 2021. This had widened IG US’ market share to 7 percent as the US fifth-largest holder of retail FX funds.

Meanwhile, GAIN Capital’s client assets rose by $1.3 million, to $208 million, which is up 1 percent over a monthly basis.

The worst performer for the month, and actually the only loser, was Interactive Brokers which saw an overall fall of $6 million to $47 million, compared to $54 million at the end of June, or 12 percent lower month-over-month.

In addition, Nebraska-based TD Ameritrade reported a slight increase over last month’s figure by nearly $172,000 to $61 million at the end of July 2021.

Furthermore, OANDA Corporation saw an overall increase of $2.7 million to $194 million, compared to $191 million in the month prior, reflecting a 1 percent decrease month-over-month.

Looking at the market share of different brokers, distribution showed a marginal change in July relative to the month prior. GAIN Capital remains the paramount player in the US with a 38.0 percent share. OANDA also solidified its stance as the second largest in the US with 35.0 percent market share – TD Ameritrade and Interactive Brokers retain 11.0 and 9.0 percent shares respectively.

The chart listed below outlines the full list of all FCMs that held Retail Forex Obligations in the month ending on July 31, 2021 – for purposes of comparison, the figures have been included against their June counterparts to illustrate disparities.