Interactive Brokers’ mobile app enhances Trades section

Users of IBKR Mobile for iOS-powered devices can now browse seven days of trades.

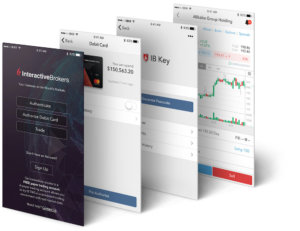

Electronic trading major Interactive Brokers Group, Inc. (NASDAQ:IBKR) has just released the latest version of the IBKR Mobile app for iOS-based gadgets, with enhancements focused on access to trades information.

The most recent version of the solution (8.53) improves the Trades section of the Orders & Trades screen so that it now allows traders to browse seven days of trades, instead of just today’s trades. This is, of course, a welcome development for those who would like to keep an eye on past trading.

The broker has been regularly updating its mobile solutions. In July this year, the broker expanded the range of trading instruments available on the IBKR Mobile app for iOS and Android devices by adding mutual funds. One may find a fund using the symbol or fund family name.

This happened after earlier this year the mobile apps started offering bonds trading. Users of the solution can trade municipal and corporate bonds.

Recent enhancements to the mobile apps concern the so-called Greeks. The latter help traders determine how certain factors affect the price of an option. For instance, Delta is a measure of an option’s sensitivity to changes in the price of the underlying asset, whereas Theta quantifies the risk that time has on options as options are only exercisable for a certain period of time.

Users of the IBKR Mobile apps for Android and iOS devices are able to view SPX Delta and SPX Theta for their portfolios. In the Android app, traders can activate this feature from their Portfolio screen by tapping the menu (three vertical dots in the upper right corner) and checking “Show Delta & Theta.” These values display along the bottom of the dashboard of the Portfolio screen.

In May this year, Interactive Brokers boosted the functionalities of the mobile app related to the Interactive Brokers Debit Mastercard. As a result of the upgrade, the apps allow traders to see how much they can spend. When traders access their Interactive Brokers Debit Mastercard from IBKR Mobile, they can now view available credit where it asks “How much can I spend” by clicking Check. The value shown is the spending limit as of the time shown, e.g. “Updated 1 minute ago”, and shows the amount available for pre-authorization.