Interactive Brokers sees largest inflow of FX deposits in March

The Commodity Futures Trading Commission (CFTC) has published its anticipated monthly report for March 2023, which covers data for FCMs that are registered as Retail Foreign Exchange Dealers (RFEDs) and those included as broker dealers that hold retail Forex obligations in the United States.

The total assets belonging to the U.S. retail forex traders grew only slightly in March, limited by the overall static performance seen throughout 2023. With no major changes recently noted and three months reported so far in the year, the sector was tracking for a stable start to the second quarter. Yet, forex products are still a tough sale in the United States, despite the obvious benefits that a highly regulated environment can offer to traders.

That should come as no surprise, though the prospect of lighter regulations may soon revive interest in the US market among foreign brokers, or at least help brighten the outlook for a retail industry that has struggled for quite some time under the provisions of the Dodd-Frank legislation.

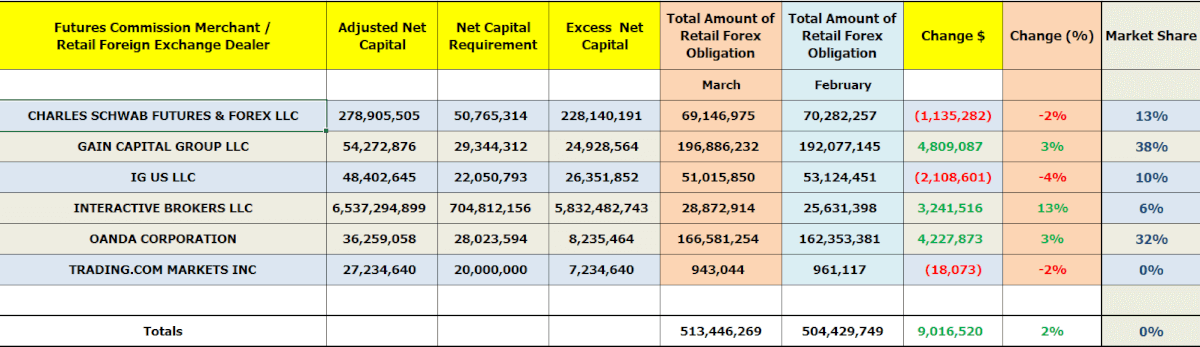

Retail forex deposits in the US have been largely skewed positively during March. The FX funds held at registered brokers operating in the United States came in at $513 million in March 2023, which is $9 million more than the $504 million reported in February.

According to the CFTC dataset, three FX firms notched increases in Retail Forex Obligations including GAIN Capital, Interactive Brokers (NASDAQ:IBKR), and Oanda. The best performer for the month was IBKR which saw an overall rise of $3.2 million to $28.8 million at the end of March 2023, or an increase by 13 percent month-over-month.

Meanwhile, GAIN Capital boosted its customer deposits to $197 million in March, up 3 percent from $192 million a month earlier. Further, OANDA Corporation racked up $4.2 million in additional deposits to $167 million in March 2023.

The newest comer to the US FX industry, Trading.com Markets, saw its retail deposits drop by two percent, staying below the $1 million mark.

Other highlights from the CFTC’s monthly report show that retail deposits at IG fell by more than $2million to $51 million in March 2020. Additionally, Charles Schwab’s client funds were down $1.1 million, or two percent lower than a month earlier.

Looking at the market share of different brokers, the overall distribution saw a slight change in March relative to the month prior. GAIN Capital remained the leader in terms of market share, commanding a 38.0 percent share. OANDA also solidified its stance as the second largest in the US with 32.0 percent market share – Charles Schwab and IG US retain a 13.0 and 10.0 percent share respectively.

The chart listed below outlines the full list of all FCMs that held Retail Forex Obligations in the month ending on March 31, 2023 – for purposes of comparison, the figures have been included against their February 2023 counterparts to illustrate disparities.