Interactive Brokers sees largest outflow of retail FX deposits in January

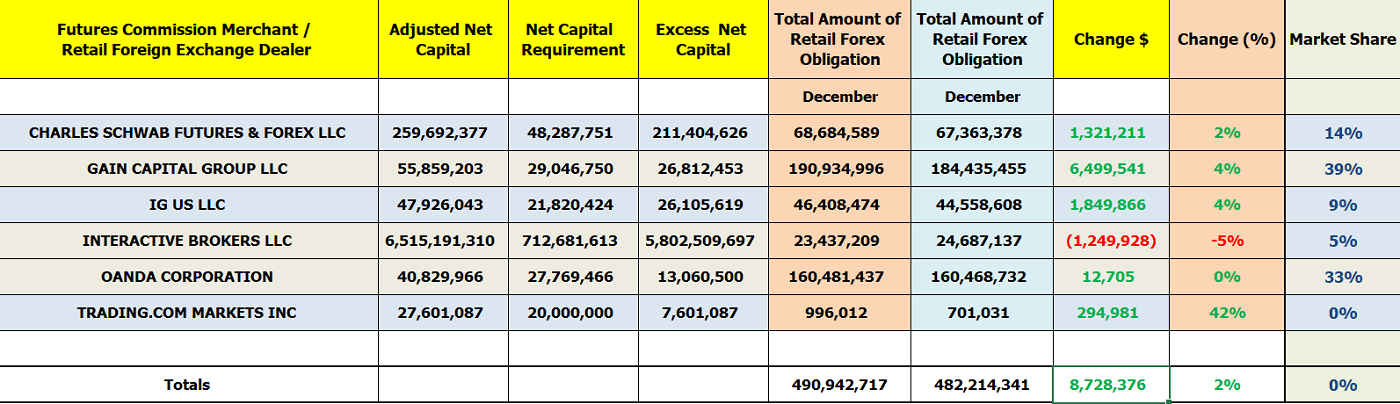

Retail FX deposits at US brokerages, which have been struggling to eke out a profit in a strict regulatory environment, rose slightly in January 2023 by $8.8 million, CFTC data showed.

The brokers, including FCMs that are registered as Retail Foreign Exchange Dealers (RFEDs) and those included as broker-dealers, saw a collective positive change in clients’ deposits month-over-month from December, though differences amongst each broker were more pronounced.

Specifically, the FX funds held at registered brokerages operating in the United States came in at $491 million in January 2022, which is 2 percent higher than the $482 million reported in December.

The newest comer to the US FX industry, Trading.com Markets, continues to take a bigger chunk of the overall retail funds, but at a very limited scale. The broker racked up $996,000 in customer deposits in January, up 42 percent from just $701,000 a month earlier.

The US arm of forex brand XM provides retail foreign exchange services to US traders amid a tough regulatory environment that has squeezed other providers out of that market. Trading.com first applied for a forex broker license in the US back in January 2019. The company, however, still has a long way to go to challenge the likes of GAIN Capital and Oanda, which command nearly 70 percent of the US retail market.

Other highlights from the CFTC’s monthly report shows that Interactive Brokers LLC (NASDAQ:IBKR) has racked up $23.4 million in total deposits. This was down by 5 percent from $26.4 million in the prior month.

Meanwhile in January, GAIN Capital was the best performer with nearly $6.5 million in additional deposits, or 4 percent higher on a monthly basis, coming in at $191 million in total.

IG US also reported an overall increase of $1.84 million to $46.4 million at the end of January 2022, or a rise by four percent month-over-month.

After consecutive increases in its market share, Oanda shows lacklustre performance in retail deposits in January 2022. Specifically, the Canada-headquartered FX broker’s net balances rose by $12,000, to $160.4 million.

Additionally, Charles Schwab reported some positive changes in client deposits, having risen by $1.3 million or 2 percent month-over-month.

The chart listed below outlines the full list of all FCMs that held Retail Forex Obligations in the month ending January 31, 2023. For purposes of comparison, the figures have been included against their December 2022 counterparts to illustrate disparities.